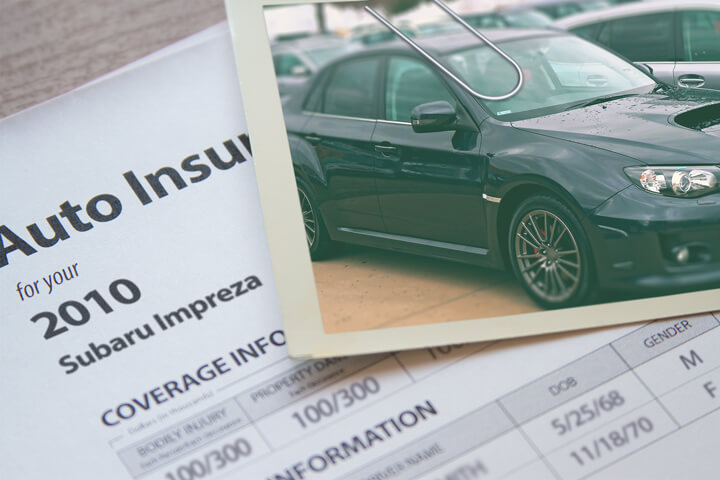

Cheapest 2010 Subaru Impreza Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

UPDATED: Jun 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

If you are a novice to online car insurance shopping, you may be overwhelmed due to the large number of companies competing for business.

The purpose of this post is to tell you the best way to quote coverages and some tricks to saving. If you are paying for car insurance now, you will be able to cut costs considerably using these tips. But car owners should learn the methods companies use to sell insurance online and apply this information to your search.

Verify you’re getting all your discounts

Car insurance is not cheap, buy you may qualify for discounts to help offset the cost. Most are applied when you get a quote, but a few need to be manually applied before you get the savings.

- Low Mileage – Fewer annual miles on your Subaru can earn discounted rates on garaged vehicles.

- Military Discounts – Being deployed with a military unit could mean lower rates.

- Own a Home – Owning a house may earn you a small savings because owning a home demonstrates responsibility.

- Good Students Pay Less – This discount can get you a discount of up to 25%. The good student discount can last up until you turn 25.

- Sign Early and Save – A few companies offer discounts for signing up before your current expiration date. It can save you around 10%.

- Save with a New Car – Insuring a new car can save up to 30% since new cars are generally safer.

- Seat Belts Save – Buckling up and requiring all passengers to wear their seat belts could cut 10% or more off your medical payments premium.

- Life Insurance Discount – Companies who offer life insurance give lower rates if you buy auto and life insurance together.

- Air Bag Discount – Vehicles equipped with air bags can get savings of up to 25% or more.

- Drivers Education – Have your child complete a driver education course if offered at their school.

It’s important to understand that most credits do not apply to your bottom line cost. Most only cut specific coverage prices like collision or personal injury protection. Just because it seems like having all the discounts means you get insurance for free, you’re out of luck. But all discounts will reduce the cost of coverage.

For a list of insurers with discount insurance rates, click here.

Insurance Coverage Comparisons

The are a couple different ways to compare rate quotes and find the best price. By far the easiest way to find the cheapest 2010 Subaru Impreza insurance rates is to use the internet to compare rates. It is quite easy and can be accomplished in a couple of different ways.

- The recommended way consumers can analyze rates is to use a rate comparison form like this one (opens in new window). This easy form keeps you from doing separate quotation requests for each company. Completing one form will return quotes from multiple companies. This is perfect if you don’t have a lot of time.

- A harder way to get comparison quotes is to manually visit each company website to complete a price quote. For instance, we’ll pretend you want comparison quotes from Allstate, Farmers and GMAC. To find out each rate you need to take the time to go to each site and enter your information, which is why the first method is more popular. To view a list of companies in your area, click here.

- The most time-consuming way to compare rates is driving to insurance agents’ offices. The internet has reduced the need for local agents unless you prefer the professional advice that only a license agent can provide. However, consumers can comparison shop your insurance online and still use a local agent. We’ll cover that shortly.

Whichever way you use, be sure to compare exactly the same coverage information on every quote you get. If the quotes have higher or lower deductibles it’s impossible to make an equal comparison. Having just a slight variation in coverages could mean much higher rates. And when comparing insurance coverage rates, know that comparing more company’s prices helps you find better pricing.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

These factors can influence what you pay for Subaru Impreza insurance

Smart consumers have a good feel for the rating factors that help determine auto insurance rates. Understanding what determines base rates helps enable you to make changes that can help you get big savings.

The following are a few of the “ingredients” that factor into your rates.

- Frequent auto insurance claims increase rates – Companies generally give lower rates to people who file claims infrequently. If you are a frequent claim filer, you can expect either a policy non-renewal or much higher rates. Insurance coverage is designed for the large, substantial claims.

- Don’t sacrifice liability coverage – Liability insurance provides coverage when you are found liable for damages from an accident. Liability insurance provides you with a defense in court starting from day one. Liability insurance is quite affordable compared to physical damage coverage, so do not skimp.

- Allowing your policy to lapse raises rates – Driving with no insurance is illegal and your next policy will cost more because you let your insurance lapse. Not only will you pay more, but being ticketed for driving with no insurance might get you a revoked license or a big fine.

- Where you live – Living in a small town can be a good thing when it comes to auto insurance. Fewer drivers translates into fewer accidents. Urban drivers have to deal with much more traffic to deal with and a longer drive to work. More time on the road means higher likelihood of an accident.

- Where do you drive? – The higher the mileage driven in a year the more you will pay for auto insurance. The majority of insurers charge to insure your cars determined by how the vehicle is used. Cars not used for work or commuting qualify for better rates than those used for commuting. An improperly rated Impreza may be costing you. Ask your agent if your auto insurance declarations sheet properly reflects the correct usage for each vehicle.

When should I talk to an agent?

When it comes to choosing proper insurance coverage, there really is not a “perfect” insurance plan. Your needs are not the same as everyone else’s.

Here are some questions about coverages that may help highlight if your insurance needs might need professional guidance.

- Will I be non-renewed for getting a DUI or other conviction?

- Is my nanny covered when driving my vehicle?

- Do I have coverage for damage caused while driving under the influence?

- What is the minimum liability in my state?

- Can I pay claims out-of-pocket if I buy high deductibles?

- Is my cargo covered for damage or theft?

- What is no-fault insurance?

- When should I buy a commercial auto policy?

- Is my custom paint covered by insurance?

- Does my policy pay for OEM or aftermarket parts?

If you’re not sure about those questions, you might consider talking to an agent. If you want to speak to an agent in your area, simply complete this short form.

How can 21st Century, Allstate and State Farm save drivers who switch?

Car insurance providers like 21st Century, Allstate and State Farm constantly bombard you with ads on television and other media. They all say the same thing about savings if you switch to them. How can each company claim to save you money?

Different companies have a preferred profile for the type of customer that is profitable for them. For example, a profitable customer might be profiled as between 25 and 40, is a homeowner, and has great credit. A prospective insured who meets those qualifications will get the preferred rates and as a result will probably pay quite a bit less when switching companies.

Potential customers who don’t measure up to the “perfect” profile will be charged more money which leads to business not being written. Company advertisements say “drivers who switch” not “everybody who quotes” save that kind of money. This is how insurance companies can confidently make those claims.

That is why it’s extremely important to get a wide range of price quotes. It’s impossible to know the company that will provide you with the cheapest Subaru Impreza insurance rates.

Parts of your auto insurance policy

Knowing the specifics of your policy helps when choosing which coverages you need and proper limits and deductibles. Policy terminology can be confusing and even agents have difficulty translating policy wording.

Uninsured/Underinsured Motorist coverage

This provides protection when other motorists either are underinsured or have no liability coverage at all. This coverage pays for injuries sustained by your vehicle’s occupants as well as your vehicle’s damage.

Since a lot of drivers carry very low liability coverage limits, it only takes a small accident to exceed their coverage. For this reason, having high UM/UIM coverages is very important. Frequently these limits are identical to your policy’s liability coverage.

Liability auto insurance

This will cover damages or injuries you inflict on a person or their property in an accident. This coverage protects you from claims by other people, and doesn’t cover your injuries or vehicle damage.

It consists of three limits, bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. You might see liability limits of 100/300/100 that translate to $100,000 in coverage for each person’s injuries, a total of $300,000 of bodily injury coverage per accident, and a total limit of $100,000 for damage to vehicles and property. Occasionally you may see one number which is a combined single limit which limits claims to one amount rather than limiting it on a per person basis.

Liability insurance covers things such as structural damage, repair costs for stationary objects, attorney fees, funeral expenses and court costs. How much liability should you purchase? That is your choice, but buy as high a limit as you can afford.

Comprehensive coverage

Comprehensive insurance covers damage from a wide range of events other than collision. You first have to pay a deductible and the remainder of the damage will be paid by comprehensive coverage.

Comprehensive coverage pays for claims such as theft, vandalism, falling objects, damage from flooding and a tree branch falling on your vehicle. The maximum amount you’ll receive from a claim is the market value of your vehicle, so if the vehicle is not worth much it’s not worth carrying full coverage.

Collision protection

Collision insurance pays for damage to your Impreza resulting from colliding with another car or object. A deductible applies then the remaining damage will be paid by your insurance company.

Collision insurance covers claims such as sideswiping another vehicle, crashing into a building and rolling your car. Collision coverage makes up a good portion of your premium, so consider dropping it from lower value vehicles. You can also increase the deductible to bring the cost down.

Medical payments coverage and PIP

Personal Injury Protection (PIP) and medical payments coverage provide coverage for bills for things like funeral costs, prosthetic devices and dental work. They are utilized in addition to your health insurance plan or if you are not covered by health insurance. Medical payments and PIP cover you and your occupants in addition to being hit by a car walking across the street. PIP is only offered in select states but it provides additional coverages not offered by medical payments coverage

Be Smart and Buy Smart

Cheaper 2010 Subaru Impreza insurance is possible on the web in addition to many insurance agents, so compare prices from both in order to have the best price selection to choose from. There are still a few companies who do not provide the ability to get a quote online and usually these regional insurance providers provide coverage only through local independent agents.

Throughout this article, we presented many ideas to save on insurance. The key thing to remember is the more price quotes you have, the better your comparison will be. You may be surprised to find that the lowest rates come from some of the lesser-known companies.

Drivers switch companies for many reasons like extreme rates for teen drivers, being labeled a high risk driver, policy cancellation or not issuing a premium refund. It doesn’t matter why you want to switch finding a great new company can be easier than you think.

Use our FREE quote tool to compare rates now!

Much more information about insurance coverage can be read at these links:

- What Determines the Price of My Auto Insurance Policy? (Insurance Information Institute)

- Can I Drive Legally without Insurance? (Insurance Information Institute)

- Should I Buy a New or Used Car? (Allstate)

- Rental Reimbursement Coverage (Allstate)

Frequently Asked Questions

How can I find cheap auto insurance rates for my 2010 Subaru Impreza in 2023?

To find cheap auto insurance rates for your 2010 Subaru Impreza, you can use our free quote tool. Simply enter your ZIP code, and you’ll be able to view companies that offer affordable auto insurance rates specifically for your vehicle.

What factors can influence the cost of my Subaru Impreza insurance?

Several factors can impact your Subaru Impreza insurance rates. Some of the key factors include your driving history, location, age, credit score, coverage options, and the insurance provider you choose. Understanding these factors can help you make changes that may result in significant savings on your insurance premiums.

How do I verify if I’m getting all the discounts available for my car insurance?

reduce your auto insurance costs. While some discounts are automatically applied when you get a quote, others may need to be manually applied. Make sure to review the list of available discounts provided by the insurance companies and inquire with them to ensure you’re getting all the applicable discounts.

Should I talk to an insurance agent to determine my coverage needs?

Deciding on the right insurance coverage can be a complex task. If you’re unsure about your coverage needs, it’s advisable to speak with an insurance agent. They can help assess your unique requirements and guide you in selecting the appropriate coverage options that provide adequate protection for your specific situation.

How can insurance providers like 21st Century, Allstate, and State Farm save drivers who switch?

Insurance companies often advertise potential savings when drivers switch to their services. However, these savings are based on various factors. Each insurance company has a preferred customer profile that they consider profitable. If you fit their preferred profile—for example, if you’re between 25 and 40, a homeowner, and have good credit—you may be eligible for lower rates when you switch. It’s essential to compare quotes from multiple companies to find the one that offers the most competitive rates for your Subaru Impreza.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Hyundai Elantra Insurance

- Honda CR-V Insurance

- Dodge Ram Insurance

- Toyota Camry Insurance

- Ford F-150 Insurance

- Toyota Corolla Insurance

- Kia Forte Insurance

- Ford Fusion Insurance

- Chevrolet Silverado Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area