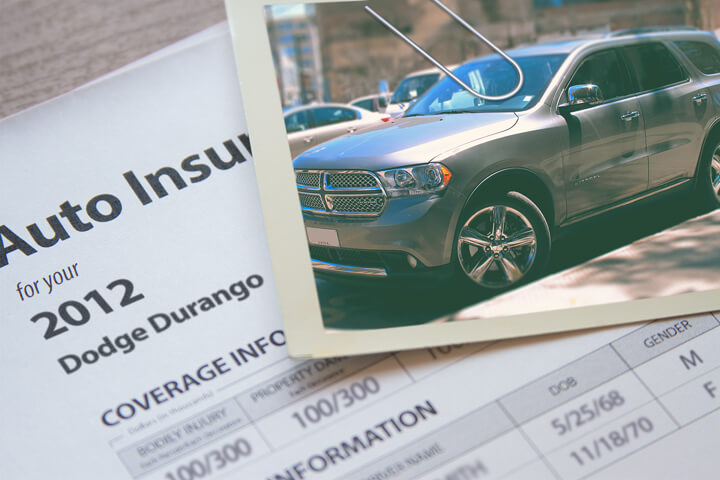

Cheapest 2012 Dodge Durango Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

UPDATED: Jun 8, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Are you intimidated by the sheer number of auto insurance options? Many other drivers are as well. Consumers have so many options that it can be a ton of work to find the lowest price.

It’s a good idea to take a look at other company’s rates periodically due to the fact that insurance rates are constantly changing. Even if you got the lowest rates on Durango insurance six months ago a different company probably has better rates today. Ignore everything you know about auto insurance because we’re going to demonstrate the things you must know in order to find great coverage at a great price.

How to reduce 2012 Dodge Durango insurance rates

Car insurance companies don’t list every available discount in a way that’s easy to find, so here is a list some of the best known as well as the least known savings tricks you should be using.

- Anti-lock Brake System – Anti-lock brake equipped vehicles can avoid accidents and earn discounts up to 10%.

- Drive Less and Save – Driving fewer miles could qualify for lower rates on the low mileage vehicles.

- Multi-car Discount – Buying coverage for more than one vehicle on the same insurance coverage policy may reduce the rate for each vehicle.

- Accident Waiver – Certain companies will allow you to have one accident without raising rates as long as you don’t have any claims for a set time period.

- Early Switch Discount – Some insurance companies reward drivers for signing up prior to your current policy expiration. It’s a savings of about 10%.

- Payment Method – If paying your policy premium upfront rather than paying monthly you may reduce your total bill.

- Senior Discount – Older drivers may qualify for better insurance coverage rates on Durango insurance.

- Club Memberships – Belonging to a qualifying organization could trigger savings when buying insurance coverage on Durango insurance.

Drivers should understand that most credits do not apply to your bottom line cost. Some only apply to the price of certain insurance coverages like liability, collision or medical payments. Just because you may think it’s possible to get free car insurance, companies wouldn’t make money that way.

To see a list of insurers with discount insurance coverage rates, click here to view.

Factors influencing Dodge Durango insurance rates

Smart consumers have a good feel for the rating factors that come into play when calculating the price you pay for auto insurance. When you know what positively or negatively controls the rates you pay empowers consumers to make smart changes that can help you get better auto insurance rates.

- Where you reside plays a part – Choosing to live in less populated areas has it’s advantages when it comes to auto insurance. Less people living in that area means a lower chance of having an accident. Drivers in populated areas have to deal with congested traffic and longer commute times. More time on the road means more change of being in an accident.

- How credit affects auto insurance rates – A driver’s credit score is a huge factor in determining what you pay for auto insurance. People with high credit ratings tend to be more responsible than those with lower credit ratings. If your credit is low, you could be paying less to insure your 2012 Dodge Durango by spending a little time repairing your credit.

- One company can mean more discounts – Most insurance companies give discounts to customers who buy several policies from them such as combining an auto and homeowners policy. Discounts can amount to 10 percent or more. Even though this discount sounds good, it’s in your best interest to shop around to confirm you are receiving the best rates possible. You may still be able to find better rates by buying insurance from more than one company.

- Drive less and save money – Driving more miles in a year the more you’ll pay to insure your vehicle. Almost all companies rate vehicles determined by how the vehicle is used. Cars and trucks left parked in the garage receive lower rates compared to those used for work or business. Make sure your auto insurance coverage properly reflects the proper vehicle usage, because improper ratings can cost you money. Incorrect usage on your Durango may be costing you.

Tailor your coverage to you

When buying adequate coverage for your personal vehicles, there really is no perfect coverage plan. Everyone’s needs are different.

For example, these questions might help in determining whether or not you would benefit from professional advice.

- I have a DUI can I still get coverage?

- Are rental cars covered under my policy?

- What can I do if my company won’t pay a claim?

- Am I covered by my employer’s commercial auto policy when driving my personal car for business?

- Can my babysitter drive my car?

- Do I need higher collision deductibles?

- Does my 2012 Dodge Durango need full coverage?

- At what point should I drop full coverage?

- Do all my vehicles need collision coverage?

If you can’t answer these questions, you may need to chat with a licensed insurance agent. If you want to speak to an agent in your area, complete this form.

Detailed coverages of your insurance policy

Knowing the specifics of your policy aids in choosing the right coverages and the correct deductibles and limits. The coverage terms in a policy can be difficult to understand and reading a policy is terribly boring.

Medical expense coverage – Med pay and PIP coverage kick in for expenses such as chiropractic care, prosthetic devices and ambulance fees. They can be utilized in addition to your health insurance program or if there is no health insurance coverage. It covers not only the driver but also the vehicle occupants in addition to if you are hit as a while walking down the street. PIP coverage is not an option in every state and may carry a deductible

Comprehensive protection – This covers damage from a wide range of events other than collision. You first have to pay a deductible and then insurance will cover the rest of the damage.

Comprehensive coverage protects against claims like rock chips in glass, falling objects, theft and hitting a bird. The maximum payout a insurance company will pay at claim time is the actual cash value, so if the vehicle’s value is low consider dropping full coverage.

Coverage for liability – This will cover damage that occurs to people or other property in an accident. This insurance protects YOU against other people’s claims, and doesn’t cover your own vehicle damage or injuries.

It consists of three limits, bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. You commonly see liability limits of 25/50/25 which means $25,000 in coverage for each person’s injuries, a total of $50,000 of bodily injury coverage per accident, and a total limit of $25,000 for damage to vehicles and property.

Liability can pay for things like court costs, legal defense fees and funeral expenses. How much coverage you buy is a personal decision, but consider buying as high a limit as you can afford.

Uninsured or underinsured coverage – This protects you and your vehicle’s occupants when other motorists do not carry enough liability coverage. Covered losses include medical payments for you and your occupants as well as damage to your Dodge Durango.

Since many drivers only carry the minimum required liability limits, their liability coverage can quickly be exhausted. So UM/UIM coverage is a good idea.

Collision coverages – This coverage pays to fix your vehicle from damage caused by collision with a stationary object or other vehicle. You first must pay a deductible and then insurance will cover the remainder.

Collision coverage pays for claims such as colliding with another moving vehicle, colliding with a tree, sustaining damage from a pot hole, rolling your car and crashing into a building. Collision coverage makes up a good portion of your premium, so consider removing coverage from vehicles that are older. Another option is to choose a higher deductible to save money on collision insurance.

Never pay more for less

People switch companies for many reasons like extreme rates for teen drivers, lack of trust in their agent, policy non-renewal or high rates after DUI convictions. Whatever your reason, choosing a new insurance company is pretty simple and you could end up saving a buck or two.

In this article, we covered a lot of techniques to save on 2012 Dodge Durango insurance. The key thing to remember is the more rate quotes you have, the better your chances of lowering your rates. You may be surprised to find that the lowest rates come from the least-expected company.

Budget-conscious insurance is attainable on the web and with local insurance agents, and you should compare price quotes from both to have the best rate selection. A few companies do not offer you the ability to get quotes online and most of the time these small, regional companies sell through independent agents.

More information is located at these links:

- Comprehensive Coverage (Liberty Mutual)

- Coverage Information (Progressive Insurance)

- Safety Tips for Teen Drivers (Insurance Information Institute)

- Understanding your Policy (NAIC.org)

Frequently Asked Questions

What factors can affect the insurance rates for a 2012 Dodge Durango?

Several factors can impact the insurance rates for a 2012 Dodge Durango. These factors include the driver’s age, driving record, location, annual mileage, coverage options selected, and the insurance company’s individual pricing policies. Additionally, the Dodge Durango’s model, trim level, engine size, and value can also influence insurance rates.

How can I find the cheapest insurance rates for a 2012 Dodge Durango?

To find the most affordable insurance rates for a 2012 Dodge Durango, it is recommended to obtain quotes from multiple insurance companies. Contact insurers directly or use online comparison tools to gather quotes and compare coverage options. Providing accurate information when requesting quotes is important to ensure the rates are as precise as possible.

Are there any specific insurance companies known for offering competitive rates on 2012 Dodge Durango insurance?

Insurance rates can vary significantly between companies, so it is advisable to obtain quotes from multiple insurers to find the best rates for a 2012 Dodge Durango. Some insurers that are often recognized for offering competitive rates on midsize SUVs like the Durango include Geico, Progressive, State Farm, and Allstate. However, it’s important to compare quotes from different insurers to find the best deal for your specific circumstances.

Can I adjust my coverage options to lower the insurance rates for my 2012 Dodge Durango?

Adjusting your coverage options can potentially help lower insurance rates. However, it is important to carefully consider the impact on your financial protection. Lowering coverage limits or removing optional coverages may result in less protection in the event of an accident or other covered incidents. It is advisable to evaluate your coverage needs and consult with your insurance provider to find the right balance between cost and coverage.

Are there any aftermarket modifications that can help reduce insurance rates for a 2012 Dodge Durango?

While some modifications, such as installing safety features or anti-theft devices, may reduce the risk of theft or accidents and potentially lead to lower insurance premiums, it is advisable to consult with your insurance provider. Some modifications may not directly affect insurance rates, and others may even increase rates if they alter the performance or value of the vehicle. It’s crucial to discuss any modifications with your insurer to understand their impact on your insurance premiums.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Toyota Sienna Insurance

- Ford Focus Insurance

- Dodge Ram Insurance

- GMC Sierra Insurance

- Toyota Corolla Insurance

- Honda Accord Insurance

- Toyota Highlander Insurance

- Honda Civic Insurance

- Nissan Rogue Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area