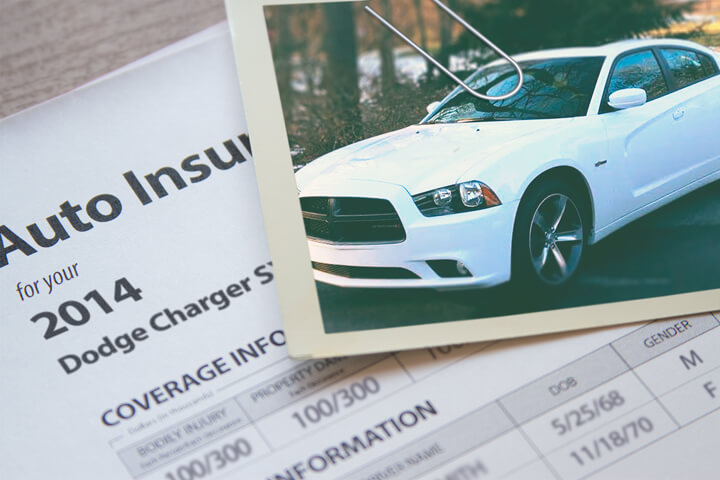

Cheapest 2014 Dodge Charger Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

UPDATED: Jun 5, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Searching for the cheapest insurance rates for your Dodge Charger? Are you tired of being strong-armed each month for car insurance? You are no different than millions of other consumers.

You have so many insurance companies to insure vehicles with, and although it’s nice to have a choice, having more car insurance companies makes it harder to find the lowest cost provider.

Finding the best rates is not rocket science. If you have car insurance now, you should be able to cut costs considerably using these tips. Although vehicle owners do need to learn the methods companies use to market insurance on the web.

Comprehensive Car Insurance Comparison

When shopping for car insurance there are multiple ways to compare rate quotes and find the best price. The easiest way by far to find competitive 2014 Dodge Charger insurance rates is simply to get online rate quotes. This can be accomplished in a couple of different ways.

The single most time-saving way consumers can make multiple comparisons is a comparison rater form click here to open form in new window. This form eliminates the need for separate quote forms for each company you want a rate for. A single, simple form gets you coverage quotes instantly.

A more time consuming way to find lower rates consists of going to each company website to complete a price quote. For sake of this example, we’ll pretend you want rates from GEICO, 21st Century and Liberty Mutual. To get rate quotes you would need to go to every website and enter your policy data, and that’s why the first method is more popular.

For a list of links to companies insuring cars in your area, click here.

Whichever method you choose, double check that you are using apples-to-apples coverage limits and deductibles on every quote you get. If you use higher or lower deductibles you will not be able to determine the lowest rate for your Dodge Charger. Just a small difference in coverages could mean much higher rates. It’s important to know that comparing a large number of companies will increase your chances of finding the best offered rates.

These Ten Discounts Can Slash Insurance Rates

Car insurance companies don’t always advertise all available discounts in a way that’s easy to find, so we break down both well-publicized as well as the least known discounts you could be receiving.

- Organization Discounts – Participating in a qualifying organization could trigger savings when buying insurance on Charger coverage.

- Paperless Signup – A few companies will discount your bill up to fifty bucks for buying a policy and signing up digitally online.

- Student in College – Kids in college who live away from home and do not have a car may be able to be covered for less.

- Pay Upfront and Save – By paying your policy upfront instead of paying each month you could save 5% or more.

- Save over 55 – If you’re over the age of 55, you may be able to get better insurance rates on Charger coverage.

- Seat Belts Save more than Lives – Requiring all passengers to buckle their seat belts could save 15% off your medical payments premium.

- Lower Rates for Military – Being on active duty in the military may qualify for rate reductions.

- Safety Course Discount – Successfully completing a course in driver safety can save you 5% or more and easily recoup the cost of the course.

- Low Mileage Discounts – Low mileage vehicles can qualify you for lower rates on the low mileage vehicles.

- Auto/Life Discount – Larger companies have a discount if you purchase life insurance from them.

It’s important to note that most credits do not apply to the overall cost of the policy. Most only cut the price of certain insurance coverages like physical damage coverage or medical payments. Just because you may think all the discounts add up to a free policy, companies wouldn’t make money that way.

To see a list of companies with discount insurance rates, follow this link.

When might I need the advice of an agent?

When buying coverage, there isn’t really a one size fits all plan. Every insured’s situation is different so this has to be addressed. Here are some questions about coverages that could help you determine if you might need professional guidance.

- If my pet gets injured in an accident are they covered?

- How much can I save by bundling my policies?

- What is the minimum liability in my state?

- How much liability do I need to cover my assets?

- Do I have coverage if my license is suspended?

- How can I force my company to pay a claim?

- Is my babysitter covered when using my vehicle?

If you don’t know the answers to these questions but you know they apply to you, you may need to chat with a licensed agent. If you don’t have a local agent, complete this form or you can also visit this page to select a carrier

Auto Insurance Specifics

Learning about specific coverages of a auto insurance policy can be of help when determining the best coverages and proper limits and deductibles. Policy terminology can be impossible to understand and even agents have difficulty translating policy wording. These are the usual coverages available from auto insurance companies.

Comprehensive coverage (or Other than Collision) – This pays to fix your vehicle from damage that is not covered by collision coverage. You need to pay your deductible first then the remaining damage will be covered by your comprehensive coverage.

Comprehensive can pay for claims such as hail damage, a broken windshield, falling objects and fire damage. The highest amount you can receive from a comprehensive claim is the actual cash value, so if the vehicle is not worth much it’s probably time to drop comprehensive insurance.

Uninsured Motorist or Underinsured Motorist insurance – This protects you and your vehicle when other motorists are uninsured or don’t have enough coverage. It can pay for injuries to you and your family and damage to your 2014 Dodge Charger.

Due to the fact that many drivers have only the minimum liability required by law, it only takes a small accident to exceed their coverage. That’s why carrying high Uninsured/Underinsured Motorist coverage is very important.

Insurance for medical payments – Personal Injury Protection (PIP) and medical payments coverage reimburse you for immediate expenses such as funeral costs, rehabilitation expenses and chiropractic care. The coverages can be utilized in addition to your health insurance program or if you are not covered by health insurance. It covers not only the driver but also the vehicle occupants in addition to being hit by a car walking across the street. Personal injury protection coverage is not universally available but can be used in place of medical payments coverage

Auto liability insurance – This provides protection from damage that occurs to people or other property that is your fault. This coverage protects you against claims from other people. Liability doesn’t cover your own vehicle damage or injuries.

Coverage consists of three different limits, bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. You commonly see liability limits of 50/100/50 which means a limit of $50,000 per injured person, a limit of $100,000 in injury protection per accident, and a total limit of $50,000 for damage to vehicles and property.

Liability insurance covers things like medical services, repair costs for stationary objects, attorney fees and medical expenses. How much liability should you purchase? That is a personal decision, but consider buying as large an amount as possible.

Collision coverage – Collision insurance pays to fix your vehicle from damage from colliding with a stationary object or other vehicle. You first must pay a deductible then the remaining damage will be paid by your insurance company.

Collision coverage protects against things like colliding with a tree, hitting a parking meter, sideswiping another vehicle, backing into a parked car and damaging your car on a curb. Collision is rather expensive coverage, so you might think about dropping it from vehicles that are 8 years or older. Drivers also have the option to choose a higher deductible to get cheaper collision coverage.

Shop Around and Save

We’ve covered some good ideas how you can lower your 2014 Dodge Charger insurance rates. The key concept to understand is the more times you quote, the higher the chance of saving money. You may even discover the most savings is with the smaller companies. Smaller companies can often insure niche markets at a lower cost compared to the large companies like Allstate or State Farm.

Budget-conscious insurance is possible on the web as well as from independent agents, and you should be comparing both to have the best rate selection. Some insurance providers don’t offer online price quotes and many times these small, regional companies only sell through independent insurance agents.

For more information, feel free to browse these articles:

- Rollover Crash FAQ (iihs.org)

- Where can I buy Insurance? (Insurance Information Institute)

Frequently Asked Questions

How can I find the cheapest auto insurance rates for my 2014 Dodge Charger in 2023?

To find the cheapest auto insurance rates for your 2014 Dodge Charger, you can use online rate comparison tools. Enter your ZIP code to view companies that offer cheap auto insurance rates specifically for your area. Comparing quotes from multiple companies increases your chances of finding the best rates.

What are the benefits of using a comparison rater form to get auto insurance quotes?

A comparison rater form is a time-saving way to make multiple comparisons. By filling out a single form, you can instantly receive coverage quotes from different companies. This eliminates the need to fill out separate quote forms for each company individually.

Are there any discounts available to lower my auto insurance rates?

Yes, car insurance companies offer various discounts that can help lower your insurance rates. Some well-publicized and lesser-known discounts include safe driver discounts, multi-policy discounts, good student discounts, and more. It’s important to note that discounts may not apply to the overall cost of the policy but can reduce the price of specific coverages.

When might I need the advice of an insurance agent?

The need for professional guidance from an insurance agent can vary depending on your specific situation. If you have questions about coverages, are unsure about your insurance needs, or want personalized advice, consulting a licensed agent can be helpful. You can fill out a form or visit a carrier’s website to find an agent in your area.

What are the different types of coverages available in an auto insurance policy?

Auto insurance policies offer various coverages to protect you and your vehicle. Some common coverages include:

- Comprehensive coverage: Pays for damage to your vehicle caused by incidents other than collisions, such as hail damage, fire damage, or theft.

- Uninsured/Underinsured Motorist insurance: Protects you when other motorists are uninsured or don’t have enough coverage to pay for damages or injuries.

- Insurance for medical payments: Reimburses immediate expenses like funeral costs, rehabilitation expenses, and medical care resulting from an accident.

- Auto liability insurance: Provides protection against damage caused to others or their property when you’re at fault.

- Collision coverage: Pays for damage to your vehicle in case of a collision with another vehicle or object.

Understanding these coverages and their limits and deductibles can help you determine the best options for your specific needs.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Ford F-150 Insurance

- Toyota Rav4 Insurance

- Chevrolet Impala Insurance

- Chevrolet Silverado Insurance

- Hyundai Elantra Insurance

- Ford Edge Insurance

- Toyota Camry Insurance

- Chevrolet Traverse Insurance

- Honda CR-V Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area