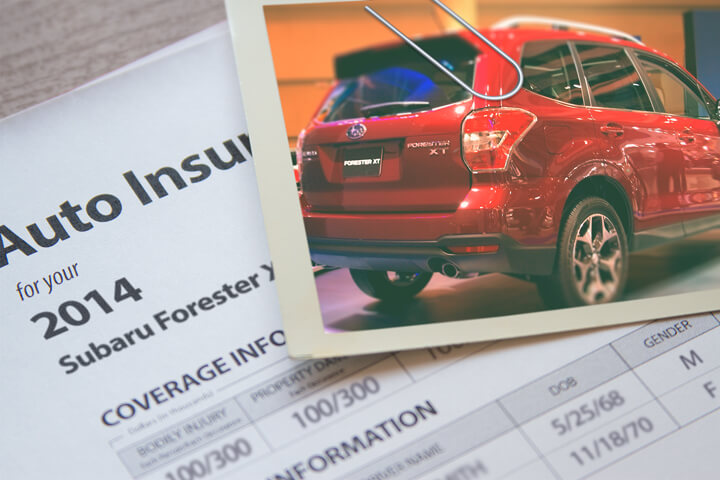

Cheapest 2014 Subaru Forester Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

UPDATED: Jun 5, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Are you a victim of an underperforming, overpriced car insurance policy? Believe me, there are a lot of people just like you who feel imprisoned by their car insurance policy. With so many options, it’s difficult to find the most affordable car insurance company.

Discounts are available to cut your rates

Insurance can be prohibitively expensive, buy you may qualify for discounts to reduce the price significantly. Larger premium reductions will be automatically applied when you purchase, but some may not be applied and must be requested specifically before they will apply. If you don’t get every credit possible, you are paying more than you should be.

- Multiple Vehicles – Having multiple vehicles on one policy can get a discount on all vehicles.

- Senior Citizens – If you’re over the age of 55, you may qualify for a discount up to 10% on Forester insurance.

- Employee of Federal Government – Simply working for the federal government may qualify you for a discount on Forester insurance with a few auto insurance companies.

- Anti-theft Discount – Vehicles with anti-theft systems help deter theft and earn discounts up to 10%.

- Life Insurance Discount – Companies who offer life insurance give lower rates if you buy life insurance.

- Passive Restraints – Vehicles with factory air bags and/or automatic seat belt systems may earn rate discounts of more than 20%.

A little note about advertised discounts, some credits don’t apply to your bottom line cost. Some only reduce specific coverage prices like comprehensive or collision. Just because you may think you can get free auto insurance, you won’t be that lucky. Any qualifying discounts will cut the cost of coverage.

To see a list of providers with discount auto insurance rates, click here.

Everyone needs different coverages

When it comes to buying the right insurance coverage, there is no “perfect” insurance plan. Coverage needs to be tailored to your specific needs so this has to be addressed. Here are some questions about coverages that could help you determine if you would benefit from an agent’s advice.

- Why is insurance for a teen driver so high?

- What is medical payments coverage?

- Is my trailer covered?

- Do I need replacement cost coverage on my 2014 Subaru Forester?

- Should I have combined single limit or split liability limits?

- Is business property covered if stolen from my car?

- Does liability extend to a camper or trailer?

- Can I rent a car in Mexico?

If you don’t know the answers to these questions but you know they apply to you, then you may want to think about talking to an insurance agent. To find lower rates from a local agent, take a second and complete this form or go to this page to view a list of companies. It’s fast, doesn’t cost anything and can help protect your family.

Insurance coverage specifics

Having a good grasp of your insurance policy aids in choosing appropriate coverage and proper limits and deductibles. Insurance terms can be impossible to understand and even agents have difficulty translating policy wording. Below you’ll find typical coverage types available from insurance companies.

Comprehensive coverages

This pays for damage from a wide range of events other than collision. You need to pay your deductible first then your comprehensive coverage will pay.

Comprehensive coverage pays for claims such as theft, hail damage, vandalism and hitting a deer. The highest amount your insurance company will pay is the market value of your vehicle, so if the vehicle is not worth much consider removing comprehensive coverage.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Uninsured and underinsured coverage

This protects you and your vehicle from other drivers when they are uninsured or don’t have enough coverage. It can pay for injuries to you and your family and damage to your Subaru Forester.

Since a lot of drivers have only the minimum liability required by law, it doesn’t take a major accident to exceed their coverage limits. That’s why carrying high Uninsured/Underinsured Motorist coverage is a good idea. Frequently your uninsured/underinsured motorist coverages are similar to your liability insurance amounts.

Coverage for medical payments

Personal Injury Protection (PIP) and medical payments coverage kick in for bills for pain medications, hospital visits, prosthetic devices, EMT expenses and chiropractic care. They are often used to cover expenses not covered by your health insurance program or if there is no health insurance coverage. Coverage applies to not only the driver but also the vehicle occupants and will also cover being hit by a car walking across the street. PIP coverage is only offered in select states and gives slightly broader coverage than med pay

Liability coverages

This will cover injuries or damage you cause to other’s property or people in an accident. This insurance protects YOU from claims by other people. Liability doesn’t cover your injuries or vehicle damage.

It consists of three limits, bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. You commonly see liability limits of 25/50/25 that means you have a limit of $25,000 per injured person, a total of $50,000 of bodily injury coverage per accident, and a total limit of $25,000 for damage to vehicles and property. Another option is one number which is a combined single limit which combines the three limits into one amount rather than limiting it on a per person basis.

Liability coverage protects against claims such as repair bills for other people’s vehicles, emergency aid and repair costs for stationary objects. How much coverage you buy is your choice, but consider buying as large an amount as possible.

Coverage for collisions

Collision coverage will pay to fix damage to your Forester resulting from colliding with another vehicle or an object, but not an animal. You will need to pay your deductible and then insurance will cover the remainder.

Collision insurance covers things like backing into a parked car, rolling your car, damaging your car on a curb and colliding with another moving vehicle. Collision is rather expensive coverage, so consider removing coverage from lower value vehicles. You can also bump up the deductible to save money on collision insurance.

Smart shoppers get results

Budget-conscious 2014 Subaru Forester insurance can be found both online and with local insurance agents, and you need to price shop both in order to have the best chance of saving money. A few companies do not offer the ability to get a quote online and many times these regional insurance providers only sell through independent insurance agents.

When you buy insurance online, it’s very important that you do not skimp on critical coverages to save a buck or two. There have been many situations where drivers have reduced liability coverage limits and learned later that the savings was not a smart move. Your goal should be to purchase plenty of coverage at an affordable rate while not skimping on critical coverages.

Use our FREE quote tool to compare rates now!

Much more information about insurance can be read at these links:

- Tread Depth and Tire Safety (State Farm)

- Protecting Teens from Drunk Driving (Insurance Information Institute)

- Medical Payments Coverage (Liberty Mutual)

- Vehicle Insurance in the U.S. (Wikipedia)

- Prepare your Teens for Safe Driving (InsureUonline.org)

Frequently Asked Questions

What factors affect the insurance rates for a 2014 Subaru Forester?

Several factors can influence the insurance rates for a 2014 Subaru Forester, including the driver’s age and location, the vehicle’s model and trim level, the driver’s driving history, the level of coverage chosen, and the insurance provider’s specific criteria.

Is the 2014 Subaru Forester considered an affordable vehicle to insure?

The affordability of insurance for a 2014 Subaru Forester can vary depending on the factors mentioned earlier. Generally, insurance rates for the 2014 Subaru Forester are not excessively high compared to other vehicles in its class.

What are some tips to obtain cheaper insurance rates for a 2014 Subaru Forester?

To potentially secure cheaper insurance rates for a 2014 Subaru Forester, you can consider the following tips:

- Shop around and compare quotes from multiple insurance providers.

- Maintain a clean driving record with no accidents or traffic violations.

- Opt for higher deductibles, which can lower your premiums.

- Inquire about available discounts, such as multi-policy discounts or safe driver discounts.

- Install safety features in your vehicle,

How can I find the cheapest insurance rates for my 2014 Subaru Forester?

To find the cheapest insurance rates for your 2014 Subaru Forester, it’s recommended to gather quotes from various insurance providers. You can do this by contacting different insurers directly, using online insurance comparison tools, or consulting with an independent insurance agent who can help you explore multiple options.

Are there any specific insurance providers known for offering competitive rates for a 2014 Subaru Forester?

Insurance rates can vary significantly between providers, and what may be considered competitive for one person might not be the same for another. It’s essential to compare quotes from multiple insurance companies to determine which one offers the most affordable rates for your specific circumstances and coverage needs.

Are there any specific features of the 2014 Subaru Forester that may impact insurance rates?

Certain features of the 2014 Subaru Forester, such as its safety ratings, anti-lock brakes, stability control, or the presence of advanced driver assistance systems, may potentially lower insurance rates. These features can enhance the vehicle’s safety and reduce the risk of accidents, which insurers often take into consideration when calculating premiums.

Can I change my insurance coverage to lower my rates for a 2014 Subaru Forester?

Adjusting your insurance coverage can be a viable way to lower your rates for a 2014 Subaru Forester. However, it’s crucial to ensure that the coverage still meets your needs and provides adequate protection. Before making any changes, it’s recommended to consult with your insurance provider or agent to understand the potential impact on coverage and premiums.

Is it possible to qualify for discounts on insurance rates for a 2014 Subaru Forester?.

Yes, it is possible to qualify for discounts on insurance rates for a 2014 Subaru Forester. Many insurance companies offer various discounts based on factors such as safe driving history, multiple policies with the same insurer, bundling home and auto insurance, good student discounts for young drivers, and more. It’s best to inquire with your insurance provider about the available discounts that you may be eligible for.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Honda Accord Insurance

- Toyota Corolla Insurance

- Ford Fusion Insurance

- Nissan Rogue Insurance

- Toyota Camry Insurance

- Honda Civic Insurance

- Chevrolet Silverado Insurance

- Toyota Rav4 Insurance

- Dodge Ram Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area