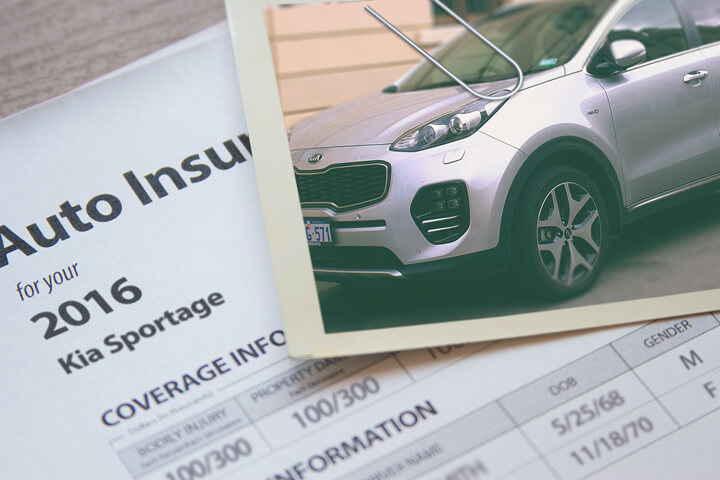

Cheapest 2016 Kia Sportage Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Pricey car insurance can bottom out your funds and make it hard to pay other bills. Getting a rate comparison is an excellent way to ensure you are getting the best deal.

Numerous auto insurance companies battle to insure your vehicles, and because of this it can be hard to compare auto insurance companies to discover the definitive best rates possible.

It’s smart to do price comparisons before your next renewal because rates fluctuate regularly. Even if you think you had the best rate on Sportage insurance last year you may be paying too much now. Forget all the misinformation about car insurance because I’m going to let you in on the secrets to the proper way to find better coverage at a better price.

If you have a policy now or are looking for a new policy, you can follow these tips to get lower rates and possibly find even better coverage. Choosing the best insurance company for you is easy if you know what you’re doing. Consumers just need to learn the best way to shop for car insurance on the web.

How to buy insurance

There are multiple methods to shop for insurance, and some are easier and takes less work. You can waste a few hours (or days) driving to insurance companies in your area, or you could save time and use the web to get rate comparisons in just a few minutes.

The majority of car insurance companies participate in an industry program where prospective buyers submit one quote, and each participating company then returns a price quote based on that information. This system prevents you from having to do quote forms for each company.

To compare pricing click here (opens in new window).

The only downside to using this type of system is you don’t know exactly which carriers you want pricing from. So if you want to choose from a list of companies to compare, we have a page of the cheapest insurance companies in your area. Click here for list of insurance companies.

Whichever way you use, make absolute certain that you use the exact same coverages on every quote you get. If you are comparing mixed coverages it’s not possible to decipher which rate is best.

Will you really save $415 on auto insurance?

Consumers constantly see and hear ads for cheaper auto insurance by Allstate, GEICO and Progressive. They all seem to state the claim about saving some big amount after switching your auto insurance coverage to their company.

That’s great but how can every company offer drivers better rates? It’s all in how they say it.

Companies have specific characteristics for the type of customer that will most likely be profitable. One example of a driver they prefer could be a married female, insures multiple vehicles, and the vehicle is rated for pleasure use. A customer getting a price quote that matches those criteria receives the best prices and will probably save if they switch.

Potential customers who don’t measure up to this ideal profile will be quoted higher rates which results in the customer buying from someone else. If you pay attention, the ads say “people who switch” but not “all drivers who get quotes” can save as much as they claim. That’s why insurance companies can make the claims of big savings. This illustrates why drivers should compare price quotes frequently. Because you never know the company that will have the best prices.

Insurance discounts are available to lower your rates

Auto insurance companies do not advertise all possible discounts very clearly, so the following list contains a few of the more well known as well as some of the hidden credits that you can use to lower your rates.

- Theft Deterent System – Vehicles that have factory alarm systems and tracking devices prevent vehicle theft and that can save you a little bit as well.

- Defensive Driver – Taking part in a defensive driver class could possibly earn you a 5% discount and also improve your driving technique.

- Multi-line Discount – Not every insurance company offers life insurance, but if they do you may earn better prices if you take out life insurance from them.

- No Accidents – Drivers with accident-free driving histories can save substantially in comparison with insureds who have frequent claims or accidents.

- Good Drivers – Drivers without accidents can get discounts for up to 45% lower rates on Sportage insurance than drivers with accidents.

- College Student Discount – living away from home attending college and do not have a car can be insured at a reduced rate.

- Online Discount – Many insurance companies will discount your bill up to fifty bucks get auto insurance online.

- Pay Now and Pay Less – If you pay your entire premium ahead of time instead of monthly or quarterly installments you may have a lower total premium amount.

While discounts sound great, it’s important to understand that most discounts do not apply to the entire cost. Some only reduce specific coverage prices like medical payments or collision. So even though it sounds like you would end up receiving a 100% discount, that’s just not realistic. But any discount will definitely lower your overall bill.

Some companies that may offer policyholders most of the discounts above include:

Before you buy a policy, ask each company which discounts can lower your rates. Some discounts might not apply in your area. To see insurance companies with discount rates, click here to view.

Everyone needs different insurance coverages

When it comes to buying the best insurance coverage, there isn’t really a “best” method to buy coverage. Everyone’s needs are different so your insurance needs to address that. For instance, these questions could help you determine if you would benefit from professional advice.

- Does my insurance cover a custom paint job?

- Am I missing any policy discounts?

- Why does it cost so much to insure a teen driver?

- Do I need rental car coverage?

- What is medical payments coverage?

- Am I covered if hit by an uninsured driver?

- Are my tools covered if they get stolen from my vehicle?

- Is my vehicle covered by my employer’s policy when using it for work?

If you can’t answer these questions, you might consider talking to an insurance agent. If you want to speak to an agent in your area, take a second and complete this form or go to this page to view a list of companies. It is quick, free and may give you better protection.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Detailed coverages of your insurance policy

Learning about specific coverages of a insurance policy can help you determine appropriate coverage and proper limits and deductibles. Insurance terms can be confusing and nobody wants to actually read their policy. These are the usual coverages available from insurance companies.

Liability coverages

Liability insurance protects you from injuries or damage you cause to other’s property or people in an accident. This insurance protects YOU against claims from other people, and doesn’t cover your own vehicle damage or injuries.

Split limit liability has three limits of coverage: bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. You might see liability limits of 100/300/100 that means you have a $100,000 limit per person for injuries, a limit of $300,000 in injury protection per accident, and a limit of $100,000 paid for damaged property.

Liability insurance covers things such as loss of income, legal defense fees, structural damage and medical services. How much liability coverage do you need? That is your choice, but you should buy as high a limit as you can afford.

Comprehensive insurance

Comprehensive insurance coverage will pay to fix damage caused by mother nature, theft, vandalism and other events. A deductible will apply then your comprehensive coverage will pay.

Comprehensive coverage protects against claims such as damage from getting keyed, falling objects, hail damage, a broken windshield and damage from a tornado or hurricane. The highest amount you can receive from a comprehensive claim is the market value of your vehicle, so if the vehicle’s value is low consider dropping full coverage.

Uninsured/Underinsured Motorist (UM/UIM)

Your UM/UIM coverage gives you protection when the “other guys” either are underinsured or have no liability coverage at all. This coverage pays for injuries sustained by your vehicle’s occupants as well as damage to your Kia Sportage.

Since many drivers carry very low liability coverage limits, their limits can quickly be used up. So UM/UIM coverage should not be overlooked.

Med pay and Personal Injury Protection (PIP)

Coverage for medical payments and/or PIP kick in for expenses such as surgery, X-ray expenses and nursing services. They can be utilized in addition to your health insurance program or if you do not have health coverage. Medical payments and PIP cover not only the driver but also the vehicle occupants and will also cover if you are hit as a while walking down the street. Personal injury protection coverage is not available in all states but it provides additional coverages not offered by medical payments coverage

Collision coverage

Collision coverage will pay to fix damage to your Sportage caused by collision with an object or car. You will need to pay your deductible then your collision coverage will kick in.

Collision insurance covers things like crashing into a building, hitting a parking meter and crashing into a ditch. Collision is rather expensive coverage, so you might think about dropping it from vehicles that are 8 years or older. It’s also possible to increase the deductible in order to get cheaper collision rates.

Quote often and quote early

Budget-conscious 2016 Kia Sportage insurance is attainable on the web in addition to local insurance agencies, so you should be comparing quotes from both to get a complete price analysis. Some companies do not provide rate quotes online and most of the time these regional insurance providers only sell through independent insurance agents.

While you’re price shopping online, it’s a bad idea to skimp on critical coverages to save a buck or two. There are many occasions where an insured dropped full coverage and learned later that the savings was not a smart move. Your strategy should be to buy enough coverage at the best cost and still be able to protect your assets.

Use our FREE quote tool to compare rates now!

Other resources

- Side Impact Crash Tests (iihs.org)

- Information for Teen Drivers (GEICO)

- What if I Can’t Find Coverage? (Insurance Information Institute)

- Senior Drivers (Insurance Information Institute)

- What are my Rights when Filing a Claim? (Insurance Information Institute)

- Distracted Driving Statistics (Insurance Information Institute)

Frequently Asked Questions

How can I find the cheapest auto insurance rates for my 2016 Kia Sportage?

Enter your ZIP code on our website to view companies that offer cheap auto insurance rates.

Is it true that I can save $415 on auto insurance?

While many companies claim to offer big savings, the actual amount you save depends on various factors. Comparing quotes frequently is the best way to find the company with the best prices.

What discounts are available to lower my auto insurance rates?

Auto insurance companies offer various discounts, some of which include safe driver discounts, multi-policy discounts, and good student discounts. Check with each company to see which discounts apply to you.

How do I choose the right insurance coverage for my needs?

Everyone’s insurance needs are different. It’s best to assess your specific requirements and consider factors such as liability coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and collision coverage.

What are the common coverages available in an insurance policy?

The common coverages include liability insurance, comprehensive insurance, uninsured/underinsured motorist coverage, medical payments coverage, and collision coverage. Understanding these coverages will help you determine the appropriate limits and deductibles for your policy.

How can I get lower rates on my insurance?

To get lower rates, you can shop around, compare quotes from different companies, inquire about available discounts, and consider increasing deductibles. Maintaining a clean driving record and improving your credit history can also help lower your rates.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Ford Fusion Insurance

- Toyota Camry Insurance

- GMC Sierra Insurance

- Honda Accord Insurance

- Toyota Corolla Insurance

- Honda CR-V Insurance

- Ford F-150 Insurance

- Dodge Ram Insurance

- Nissan Rogue Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area