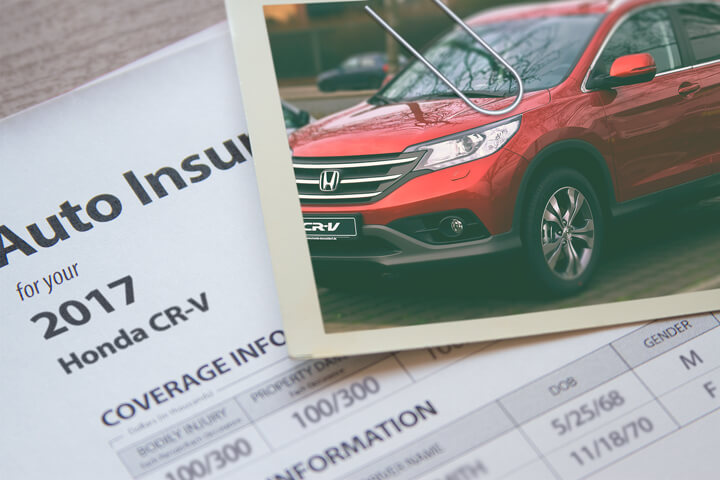

Cheapest 2017 Honda CR-V Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Searching for cheaper car insurance rates? Consumers have lots of choices when looking for low-cost Honda CR-V insurance. You can either waste hours calling around trying to get quotes or save time using the internet to compare rates. There is a better way to find car insurance online so you’re going to learn the proper way to quote coverages on a Honda and locate the cheapest rates from local insurance agents and online providers.

Don’t overlook these insurance discounts

Insurance is expensive, but there may be some discounts that could help you make your next renewal payment. A few discounts will be applied when you quote, but a few need to be inquired about before you will receive the discount.

- More Vehicles More Savings – Buying a policy with multiple cars or trucks with one company could earn a price break for each car.

- Save over 55 – Seniors may qualify for lower premium rates on CR-V coverage.

- No Accidents – Drivers with accident-free driving histories can earn big discounts in comparison with policyholders that have many claims.

- Government Employee Discount – Active or retired federal employment can earn a discount up to 10% on CR-V coverage with certain companies.

- ABS and Traction Control Discounts – Cars with anti-lock braking systems prevent accidents and earn discounts up to 10%.

- Paperless Signup – A few larger online companies will provide an incentive for signing up online.

- Anti-theft System – Anti-theft and alarm system equipped vehicles help deter theft and will save you 10% or more.

- Payment Method – By making one initial payment as opposed to paying monthly you can avoid the installment charge.

- Passive Restraints and Air Bags – Vehicles with factory air bags or motorized seat belts can get savings of up to 25% or more.

- Own a Home – Simply owning a home can save a few bucks because it shows financial diligence.

Policy discounts save money, but some credits don’t apply to the entire cost. Most cut specific coverage prices like comp or med pay. So even though they make it sound like you could get a free insurance policy, it’s just not the way it works.

Larger insurance companies and some of their more popular discounts are included below.

- Mercury Insurance discounts include age of vehicle, multi-car, ease of repair, low natural disaster claims, good student, and annual mileage.

- Farmers Insurance offers discounts including good student, switch companies, electronic funds transfer, homeowner, multi-car, and distant student.

- Farm Bureau policyholders can earn discounts including 55 and retired, youthful driver, good student, multi-policy, multi-vehicle, driver training, and safe driver.

- State Farm has savings for good driver, driver’s education, accident-free, defensive driving training, and good student.

- Allstate offers premium reductions for farm vehicle, good student, defensive driver, eSmart discount, and anti-theft.

- GEICO offers discounts for good student, multi-policy, driver training, emergency military deployment, five-year accident-free, membership and employees, and federal employee.

If you need lower rates, check with each company to give you their best rates. Discounts might not be offered on policies in your area.

Finding insurance coverage

There are a lot of ways to shop for insurance coverage, but there is one way that is less time-consuming than others. You can spend countless hours driving to insurance companies in your area, or you could use online quotes to maximize your effort.

Most major companies participate in an industry program where prospective buyers enter their coverage request one time, and every company can give them a price. This system prevents you from having to do repetitive form submissions for every insurance coverage company. To compare rates now click here (opens in new window).

The single downside to doing it this way is you don’t know exactly which carriers you want pricing from. If you prefer to choose specific providers to compare, we have a listing of companies who write insurance coverage in your area. Click to view list.

The approach you take is up to you, just be certain you are entering nearly identical coverages for each price quote. If you compare different values for each quote it will be impossible to determine the lowest rate for your Honda CR-V.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

When to get professional advice

When choosing coverage for your personal vehicles, there really is not a single plan that fits everyone. Every situation is different.

For example, these questions may help highlight if your insurance needs might need professional guidance.

- When would I need rental car insurance?

- Is my teen driver covered when they drive my company car?

- Is pleasure use cheaper than using my 2017 Honda CR-V to commute?

- Does my personal policy cover me when driving out-of-state?

- What can I do if my company won’t pay a claim?

- What exactly is covered by my policy?

- What if I don’t agree with a claim settlement offer?

- Am I covered if I drive in a foreign country?

- If my pet gets injured in an accident are they covered?

If you’re not sure about those questions but a few of them apply then you might want to talk to a licensed insurance agent. If you want to speak to an agent in your area, simply complete this short form. It’s fast, free and can help protect your family.

Auto insurance policy specifics

Learning about specific coverages of a auto insurance policy aids in choosing the best coverages and proper limits and deductibles. The terms used in a policy can be ambiguous and even agents have difficulty translating policy wording.

Collision – This pays for damage to your CR-V resulting from colliding with an object or car. You will need to pay your deductible and then insurance will cover the remainder.

Collision insurance covers claims such as backing into a parked car, sideswiping another vehicle, damaging your car on a curb, driving through your garage door and scraping a guard rail. Paying for collision coverage can be pricey, so consider dropping it from vehicles that are 8 years or older. Another option is to bump up the deductible to get cheaper collision coverage.

Protection from uninsured/underinsured drivers – Uninsured or Underinsured Motorist coverage protects you and your vehicle from other drivers when they either are underinsured or have no liability coverage at all. This coverage pays for medical payments for you and your occupants as well as damage to your Honda CR-V.

Since many drivers carry very low liability coverage limits, their liability coverage can quickly be exhausted. That’s why carrying high Uninsured/Underinsured Motorist coverage is a good idea.

Comprehensive (Other than Collision) – Comprehensive insurance covers damage caused by mother nature, theft, vandalism and other events. You first have to pay a deductible and the remainder of the damage will be paid by comprehensive coverage.

Comprehensive insurance covers claims like theft, falling objects, rock chips in glass and vandalism. The highest amount you’ll receive from a claim is the actual cash value, so if it’s not worth much more than your deductible it’s not worth carrying full coverage.

Medical expense insurance – Medical payments and Personal Injury Protection insurance pay for expenses such as surgery, prosthetic devices, nursing services, doctor visits and hospital visits. They are utilized in addition to your health insurance policy or if you lack health insurance entirely. Coverage applies to not only the driver but also the vehicle occupants as well as if you are hit as a while walking down the street. Personal Injury Protection is not universally available and may carry a deductible

Liability coverage – This provides protection from damage that occurs to other’s property or people by causing an accident. It protects you from legal claims by others, and doesn’t cover damage to your own property or vehicle.

It consists of three limits, bodily injury per person, bodily injury per accident and property damage. You might see values of 25/50/25 that means you have a $25,000 limit per person for injuries, $50,000 for the entire accident, and $25,000 of coverage for damaged property.

Liability insurance covers things such as loss of income, medical services and medical expenses. How much coverage you buy is up to you, but buy as high a limit as you can afford.

Save for a rainy day

Insureds who switch companies do it for a number of reasons such as lack of trust in their agent, not issuing a premium refund, delays in paying claims and extreme rates for teen drivers. It doesn’t matter why you want to switch finding a new insurance coverage company can be pretty painless.

Budget-friendly insurance coverage is possible online in addition to many insurance agents, and you should be comparing both to have the best rate selection. A few companies don’t offer rates over the internet and many times these regional insurance providers work with local independent agencies.

When buying insurance coverage, make sure you don’t buy lower coverage limits just to save a few bucks. In many instances, an insured cut liability coverage limits and discovered at claim time that they should have had better coverage. Your aim should be to purchase a proper amount of coverage at a price you can afford and still be able to protect your assets.

Use our FREE quote tool to compare rates now!

To read more, take a look at the resources below:

- Airbag FAQ (iihs.org)

- What Car Insurance is Cheapest for a Honda CR-V in Fort Wayne? (FortWayneInsure.com)

- Can I Drive Legally without Insurance? (Insurance Information Institute)

- State Car Insurance Guides (GEICO)

- Smart Auto Insurance Tips (Insurance Information Institute)

- How to Avoid Common Accidents (State Farm)

Frequently Asked Questions

What factors affect the cost of insurance for a 2017 Honda CR-V?

Several factors can influence the cost of insurance for a 2017 Honda CR-V. These factors include the driver’s age, driving history, location, credit score, coverage options, deductible amount, and the insurance company’s policies.

Can I find cheap insurance for a 2017 Honda CR-V?

Yes, it is possible to find affordable insurance for a 2017 Honda CR-V. By comparing quotes from different insurance providers, maintaining a good driving record, opting for higher deductibles, and taking advantage of available discounts, you can increase your chances of finding a cheaper insurance policy.

Does the location where I live affect the cost of insurance for a 2017 Honda CR-V?

Yes, the location where you live can impact the cost of insurance for a 2017 Honda CR-V. If you reside in an area with a higher population density, higher crime rates, or more frequent accidents, insurance companies may charge higher premiums to offset the increased risk.

How can I lower my insurance premiums for a 2017 Honda CR-V?

There are several ways to lower your insurance premiums for a 2017 Honda CR-V. You can opt for higher deductibles, maintain a good driving record, bundle your auto insurance with other policies, take advantage of available discounts (such as multi-car, good student, or safe driver discounts), and consider installing safety features in your vehicle.

Does my credit score affect the cost of insurance for a 2017 Honda CR-V?

Yes, in some cases, your credit score can affect the cost of insurance for a 2017 Honda CR-V. Insurance companies may consider your credit score as a factor when calculating premiums. It is generally recommended to maintain a good credit score to potentially qualify for lower insurance rates.

Can I get discounts on insurance for a 2017 Honda CR-V?

Yes, there are various discounts available that can help reduce the cost of insurance for a 2017 Honda CR-V. Some common discounts include safe driver discounts, multi-policy discounts, good student discounts, low mileage discounts, and discounts for safety features like anti-theft devices or anti-lock brakes.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Chevrolet Traverse Insurance

- Chevrolet Silverado Insurance

- Toyota Tacoma Insurance

- Dodge Ram Insurance

- Toyota Rav4 Insurance

- Chevrolet Impala Insurance

- Honda CR-V Insurance

- Honda Civic Insurance

- Nissan Rogue Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area