Cheapest Ford F-150 Insurance Rates in 2026

Enter your zip code below to view companies that have cheap auto insurance rates.

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

- The national average to insure a Ford F-150 is $112 per month

- There is a $362 annual average difference between the most expensive Ford F-150 to insure and the least expensive

- If a vehicle is larger but has a history of low claims, you could still have a lower rate

Finding cheap car insurance rates can be hard if you don’t know how rates for trucks are calculated. You’ve come to the right place if you want to learn more about Ford F-150 auto insurance costs.

We cover Ford F-150 auto insurance rates for multiple model years, so if you want to know what the 2016 F-150 insurance costs are or if trucks are expensive to insure, we’ve got you covered. Our guide also goes over the purchase cost of a Ford F-150, fatality rates, repair costs, and much more. We even look at Ford F-150 SuperCrew insurance rates.

Keep in mind that many different factors will impact your Ford F-150 auto insurance costs. For example, the age of your truck and its trim level can change what you pay for insurance. However, your driving record, age, and your state can affect your overall rates. Read on to learn more.

Want to jump right into comparing rates to determine how much it costs to insure a Ford F-150? Just enter your ZIP code into our FREE quote tool above to find affordable Ford F-150 car insurance quotes today.

What are the average Ford F-150 car insurance rates?

Finding cheap Ford F-150 car insurance rates can feel like a major chore. But don’t worry, we did the hard work for you. We have all the information you need to get started.

Comparing rates from multiple car insurance companies is key, whether you are looking for 2018 Ford F-150 car insurance costs or Ford F-150 car insurance rates for an 18-year-old driver.

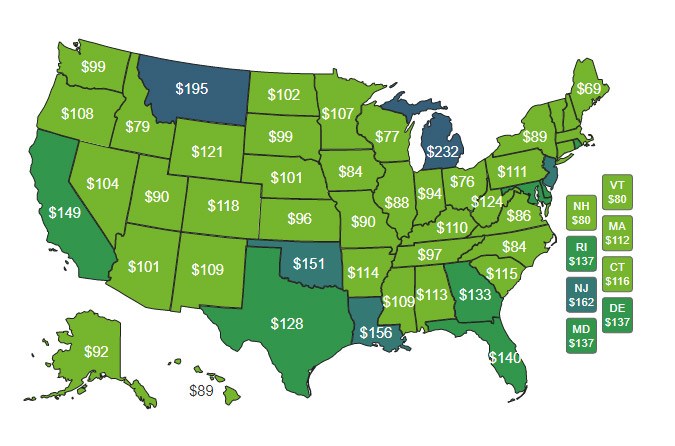

The national average to insure a Ford F-150 is $112 per month, with Maine, Iowa, and Ohio being some of the cheapest states to insure in. States like Michigan, Louisiana, and New Jersey have some of the higher rates in the U.S. The diagram below shows the monthly cost for F-150 insurance in all 50 states.

Monthly Ford F-150 Insurance Cost by State

The Ford F-150 is available in many different trim levels, and insurance cost factors in the price of the vehicle. More expensive trims like the King Ranch and Platinum cost more per year to insure than the base XL model.

The table below shows insurance rates for the different F-150 trim levels. Check out the details.

| F-150 Trim Level | Annual Rate | 6-Month Rate | Monthly Rate |

|---|---|---|---|

| F-150 XL Regular Cab 2WD | $1,254 | $627 | $105 |

| F-150 STX Regular Cab 2WD | $1,340 | $670 | $112 |

| F-150 XL Super Cab 2WD | $1,340 | $670 | $112 |

| F-150 XLT Regular Cab 2WD | $1,340 | $670 | $112 |

| F-150 STX Super Cab 2WD | $1,340 | $670 | $112 |

| F-150 XL Crew Cab 2WD | $1,374 | $687 | $115 |

| F-150 XLT Super Cab 2WD | $1,374 | $687 | $115 |

| F-150 STX Regular Cab 4WD | $1,374 | $687 | $115 |

| F-150 XL Regular Cab 4WD | $1,374 | $687 | $115 |

| F-150 FX2 Super Cab 2WD | $1,374 | $687 | $115 |

| F-150 XLT Crew Cab 2WD | $1,374 | $687 | $115 |

| F-150 XL Super Cab 4WD | $1,374 | $687 | $115 |

| F-150 XLT Regular Cab 4WD | $1,374 | $687 | $115 |

| F-150 XL Crew Cab 4WD | $1,408 | $704 | $117 |

| F-150 STX Super Cab 4WD | $1,408 | $704 | $117 |

| F-150 XLT Super Cab 4WD | $1,408 | $704 | $117 |

| F-150 FX2 2WD | $1,496 | $748 | $125 |

| F-150 Lariat Super Cab 2WD | $1,496 | $748 | $125 |

| F-150 Lariat Crew Cab 2WD | $1,496 | $748 | $125 |

| F-150 FX4 Super Cab 4WD | $1,496 | $748 | $125 |

| F-150 XLT Crew Cab 4WD | $1,496 | $748 | $125 |

| F-150 FX4 4WD | $1,496 | $748 | $125 |

| F-150 Lariat Crew Cab 4WD | $1,496 | $748 | $125 |

| F-150 SVT Raptor Super Cab 4WD | $1,496 | $748 | $125 |

| F-150 Lariat Super Cab 4WD | $1,496 | $748 | $125 |

| F-150 Lariat Crew Cab Platinum 2WD | $1,582 | $791 | $132 |

| F-150 Lariat Crew Cab Harley 2WD | $1,582 | $791 | $132 |

| F-150 Lariat King Ranch 2WD | $1,582 | $791 | $132 |

| F-150 Lariat King Ranch 4WD | $1,616 | $808 | $135 |

| F-150 Lariat Crew Cab Harley 4WD | $1,616 | $808 | $135 |

| F-150 Lariat Crew Cab Platinum 4WD | $1,616 | $808 | $135 |

There is a $362 annual average difference between the most expensive Ford F-150 to insure and the least costly. While this total difference is not too extreme, you can still save money on car insurance by investing in the right Ford F-150.

Keep in mind that the rates shown above are for a 40-year-old male driver with a clean driving record. Since insurance rates are affected substantially by speeding tickets, at-fault accidents, and even your age, you must get Ford F-150 auto insurance quotes using your own information.

You can find out how your rates compare to the national average by entering your ZIP code below.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How does the size and class of the Ford F-150 affect liability rates?

Let’s first discuss liability insurance, as this essential coverage protects you from legal action after an accident. How? If you caused an accident, liability insurance pays for the other driver’s medical and property damage bills.

So if your car can easily damage other vehicles or crashes, your liability rates may be higher. Larger, robust engines in vehicles are also riskier, as these vehicles can reach higher speeds. So if you want to know if a V8 costs more on insurance, the answer is yes.

The class=’ent _Ford_F-150′>Ford F-150 is a large pickup, some versions of which have a V8 engine, which means it is more likely to damage other vehicles. Luckily, insurers won’t just look at the size and class of your car to determine liability rates. The insurance losses of your car are also significant. If a vehicle is larger but has a history of low claims, you could still have a lower rate.

According to the Insurance Institute for Highway Safety’s (IIHS) data on insurance losses by make and model, the liability property damage losses for versions of the Ford F-150 are as follows.

- Ford F-150: 19 percent (average)

- Ford F-150 4WD: -10 percent (average)

- Ford F-150 SuperCab: 23 percent (worse than average)

- Ford F-150 SuperCab 4WD: 1 percent (average)

- Ford F-150 SuperCrew: 2 percent (average)

- Ford F-150 SuperCrew 4WD: -1 percent (average)

The only Ford F-150 model that did not receive average ratios in this category is the SuperCab. If you drive a Ford F-150 Supercab, your liability rates might be higher than other F-150 trims and models.

On the other side of the spectrum, the four-wheel-drive Ford F-150 has the best losses for property damage. It also has the best bodily injury losses (as you can see below), which means you may have a slightly lower rate if you own this version.

Check out the details.

- Ford F-150: 11 percent (average)

- Ford F-150 4WD: -40 percent (substantially better than average)

- Ford F-150 SuperCab: 9 percent (average)

- Ford F-150 SuperCab 4WD: -17 percent (average)

- Ford F-150 SuperCrew: -2 percent (average)

- Ford F-150 SuperCrew 4WD: -23 percent (better than average)

Most of the losses for both liability types are moderate, suggesting that liability rates will be standard. But if you’re wondering which Ford F-150 truck has the cheapest insurance rates for liability coverage, the answer is probably the four-wheel-drive Ford F-150.

What does liability insurance cost for the Ford F-150?

So how much does it cost to insure a pickup truck? To determine how much liability insurance is for a 2020 Ford F-150 regular cab, we pulled rates from a sample quote from Geico. Our driver is a 40-year-old male who lives in Pennsylvania, has a clean driving record, and travels 13,000 miles a year.

Let’s start with the rates for bodily injury coverage. These rates are for a six-month coverage policy.

- Low ($15,000/$30,000): $32.12

- Medium ($100,000/$200,000): $65.85

- High ($500,000/$500,000): $106.01

It only costs $74 to increase coverage from low to high, so you’ll only be paying $12 extra a month. The price changes are even lower for property damage coverage, which means you can upgrade to a high range for a reasonable amount.

- Low ($5,000): $420.41

- Medium ($20,000): $445.35

- High ($100,000): $463.58

It only costs $7 a month to upgrade your property damage coverage from low to high. This is a great price, mainly because your insurer will go from covering $5,000 of damages to $100,000. If you total someone else’s car, having higher coverage will ensure all costs are covered.

What are the safety features and ratings of the Ford F-150?

Not only do safety features help protect you, but they can also earn you a discount on car insurance. Insurers appreciate safety features, as they help prevent crashes, which means an insurer has to pay fewer claims. According to AutoBlog, the 2020 Ford F-150 has the following safety features standard with the vehicle.

- Crash prevention: anti-lock brakes and stability control.

- Crash protection: front-impact air bags, side-impact air bags, overhead air bags, and seatbelt pre-tensioners.

- Anti-theft: ignition disable device.

The Ford F-150 doesn’t have anti-whiplash headrests or knee air bags, but it still has good safety features. For instance, the overhead air bags will help protect you if you are in a roll-over accident.

In addition, IIIHS crash tests done on the 2020 Ford F-150 crew cab pickup showed great results. Below, you can see the ratings for different crash tests on the Ford F-150.

- Small overlap front (driver-side): Good

- Small overlap front (passenger-side): Good

- Moderate overlap front: Good

- Side: Good

- Roof strength: Good

- Head restraints and seats: Good

Good is the highest rating possible, so the Ford F-150 held up well in the various crash tests.

However, look up the details for your specific Ford F-150 model year and trim level. Different model years may have different safety ratings, which will impact what you pay for car insurance.

Like safety ratings, crash test results can also affect your car insurance costs for the Ford F-150.

See details about the results of the Ford F-150 crash test ratings over the years from the National Highway Traffic Safety Administration (NHTSA) in the table below.

Ford F-150 Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2020 Ford F-150 Supercab PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2020 Ford F-150 Supercab PU/EC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2020 Ford F-150 Super Crew PU/CC 4WD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Ford F-150 Super Crew PU/CC 2WD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Ford F-150 Regular Cab PU/RC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2020 Ford F-150 Regular Cab PU/RC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2019 Ford F-150 Supercab PU/EC 4x4 | 4 stars | 4 stars | 5 stars | 4 stars |

| 2019 Ford F-150 Supercab PU/EC 4x2 | 4 stars | 4 stars | 5 stars | 4 stars |

| 2019 Ford F-150 Super Crew PU/CC 4x4 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Ford F-150 Super Crew PU/CC 4x2 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Ford F-150 Regular Cab PU/RC 4x4 | 4 stars | 4 stars | 5 stars | 4 stars |

| 2019 Ford F-150 Regular Cab PU/RC 4x2 | 4 stars | 4 stars | 5 stars | 4 stars |

| 2018 Ford F-150 Supercab PU/EC 4x4 | 4 stars | 4 stars | 5 stars | 4 stars |

| 2018 Ford F-150 Supercab PU/EC 4x2 | 4 stars | 4 stars | 5 stars | 4 stars |

| 2018 Ford F-150 Super Crew PU/CC 4x4 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Ford F-150 Super Crew PU/CC 4x2 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Ford F-150 Regular Cab PU/RC 4x4 | 4 stars | 4 stars | 5 stars | 4 stars |

| 2018 Ford F-150 Regular Cab PU/RC 4x2 | 4 stars | 4 stars | 5 stars | 4 stars |

| 2017 Ford F-150 Supercab PU/EC 4x4 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Ford F-150 Supercab PU/EC 4x2 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Ford F-150 Regular Cab PU/RC 4x4 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Ford F-150 Regular Cab PU/RC 4x2 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Ford F-150 Crew Cab PU/CC 4x4 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Ford F-150 Crew Cab PU/CC 4x2 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Ford F-150 Supercab PU/EC 4x4 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Ford F-150 Super Crew PU/CC 4x4 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Ford F-150 Super Crew PU/CC 4x2 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Ford F-150 Regular Cab PU/RC 4x4 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Ford F-150 Regular Cab PU/RC 4x2 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2015 Ford F-150 Supercab PU/EC 4x4 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2015 Ford F-150 Supercab PU/EC 4x2 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2015 Ford F-150 Super Crew PU/CC 4x4 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2015 Ford F-150 Super Crew PU/CC 4x2 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2015 Ford F-150 Regular Cab PU/RC 4x4 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2015 Ford F-150 Regular Cab PU/RC 4x2 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2014 Ford F-150 Supercab PU/EC 4x4 | 4 stars | 4 stars | 5 stars | 3 stars |

| 2014 Ford F-150 Supercab PU/EC 4x2 | 4 stars | 4 stars | 5 stars | 4 stars |

| 2014 Ford F-150 Super Crew PU/CC 4x4 | 4 stars | 3 stars | 5 stars | 3 stars |

| 2014 Ford F-150 Super Crew PU/CC 4x2 | 4 stars | 3 stars | 5 stars | 4 stars |

| 2014 Ford F-150 Regular Cab PU/RC 4x4 | 4 stars | 4 stars | 5 stars | 3 stars |

| 2014 Ford F-150 Regular Cab PU/RC 4x2 | 4 stars | 4 stars | 5 stars | 4 stars |

| 2013 Ford F-150 Supercab PU/EC 4x4 | 4 stars | 4 stars | 5 stars | 3 stars |

| 2013 Ford F-150 Super Crew PU/CC 4x4 | 4 stars | 3 stars | 5 stars | 3 stars |

| 2013 Ford F-150 Super Crew PU/CC 4x2 | 4 stars | 3 stars | 5 stars | 4 stars |

| 2013 Ford F-150 Regular Cab PU/RC 4x4 | 4 stars | 4 stars | 5 stars | 3 stars |

| 2013 Ford F-150 Regular Cab PU/RC 4x2 | 4 stars | 4 stars | 5 stars | 4 stars |

| 2012 Ford F-150 Supercab PU/EC 4x4 | 4 stars | 4 stars | 5 stars | 3 stars |

| 2012 Ford F-150 Supercab PU/EC 4x2 | 4 stars | 4 stars | 5 stars | 4 stars |

| 2012 Ford F-150 Super Crew PU/CC 4x4 | 4 stars | 3 stars | 5 stars | 3 stars |

| 2012 Ford F-150 Super Crew PU/CC 4x2 | 4 stars | 3 stars | 5 stars | 4 stars |

| 2012 Ford F-150 Regular Cab PU/RC 4x4 | 4 stars | 4 stars | 5 stars | 3 stars |

| 2012 Ford F-150 Regular Cab PU/RC 4x2 | 4 stars | 4 stars | 5 stars | 4 stars |

| 2011 Ford F-150 Supercab PU/EC 4x4 | 4 stars | 3 stars | 5 stars | 3 stars |

| 2011 Ford F-150 Supercab PU/EC 4x2 | 4 stars | 3 stars | 5 stars | 4 stars |

| 2011 Ford F-150 Super Crew PU/CC 4x4 | 4 stars | 3 stars | 5 stars | 3 stars |

| 2011 Ford F-150 Super Crew PU/CC 4x2 | 4 stars | 3 stars | 5 stars | 4 stars |

| 2011 Ford F-150 Regular Cab PU/RC 4x4 | 4 stars | 3 stars | 5 stars | 3 stars |

| 2011 Ford F-150 Regular Cab PU/RC 4x2 | 4 stars | 3 stars | 5 stars | 4 stars |

A 5-star rating is the highest possible score given by the National Highway Traffic Safety Administration. As you can see, some model years of the Ford F-150 performed better than others. Previous F-150 models seem to have overall lower scores, which means they’re improving each year. Once again, we always recommend you look at the details for your specific model for the most accurate results.

The IIHS has also done a 2018 study on fatality rates, and pickups had the lowest total fatalities at 4,369 pickup fatalities. This is fewer than SUV fatalities (5,035) and car fatalities (13,138). For a breakdown of the 4,369 pickup fatalities, take a look at the list below.

- Frontal Impact: 2,493 fatalities

- Side Impact: 807 fatalities

- Rear Impact: 173 fatalities

- Other (mostly rollovers): 896 fatalities

While pickups had the lowest number of fatalities for 2018, their death rate per million vehicles was not the lowest. In 2018, there were 34 driver pickup deaths per million vehicles, which is higher than SUVs (23 fatalities per million vehicles) but lower than cars (48 fatalities per million vehicles).

All occupant fatalities for pickups (42 fatalities per million vehicles) were also higher than SUVs (32 fatalities per million vehicles) and lower than cars (69 fatalities per million vehicles). The good news is that pickups still have a low number of fatalities, and since the Ford F-150 has good crash ratings, your rate shouldn’t be too high.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What is the MSRP of the Ford F-150?

How much is a 2016 Ford F-150? What about one manufactured in 2020? To find out, you should look for the manufacturer’s suggested retail price, otherwise known as the MSRP.

The MSRP is a fixed price that the manufacturer thinks the car is worth. F-150 pricing depends on several factors, including:

- basic fuel tank size (a 23-gallon fuel tank will be cheaper than a 26-gallon fuel tank, for instance)

- engine choices

- trim and special features (many new models are equipped with Bang & Olufsen sound systems)

- bed lengths

- and more

Sellers will usually mark this price down to what is known as the invoice price, although most people will buy the car at the fair purchase price rather than the invoice price.

Because the invoice price and fair purchase prices are constantly changing, insurers use the MSRP to determine the value of a car when creating comprehensive and collision insurance rates. Why? Both these coverages pay for repairs or replacement if your car is wrecked.

- What is collision insurance and what does it cover? Collision coverage pays for repairs if you collide with another vehicle or object.

- What is comprehensive coverage on a car insurance policy? Comprehensive coverage pays for repairs if you collide with an animal, or your car is ruined by natural weather, vandalism, or theft.

Lenders will sometimes force you to carry these two coverages if you lease a car, so your lender won’t have a huge financial loss if you total the car.

So what is the MSRP of the Ford F-150? According to Kelley Blue Book (KBB), the prices for a 2020 Ford F-150 regular cab are as follows:

- MSRP: $34,735

- Invoice: $33,244

- Fair Purchase Price: $32,963

- Fair Market Range: $31,578 to $34,347

The fair purchase price is about $2,000 less than the MSRP, which shows how important it is to shop around for a car price just like you do for car insurance.

In addition to the MSRP, insurers may also use insurance losses for your vehicle to determine rates. Check out the 2020 Ford F-150 insurance loss probability in the table below.

Ford F-150 Insurance Loss Probability

| Insurance Coverage Category | Loss Rate |

|---|---|

| Collision | -36% |

| Property Damage | 19% |

| Comprehensive | -41% |

| Personal Injury | -31% |

| Medical Payment | -35% |

| Bodily Injury | 11% |

The lower the number, the better the insurance loss ratio. Fortunately, the 2020 Ford F-150 performs average to substantially better than average in every category.

However, there are still many versions of the Ford F-150. The good news is that all of them did well in the IIHS’s study of insurance losses for collision and comprehensive insurance. Let’s first take a look at collision losses.

- Ford F-150: -36 percent (substantially better than average)

- Ford F-150 4WD: -45 percent (substantially better than average)

- Ford F-150 SuperCab: -22 percent (better than average)

- Ford F-150 SuperCab 4WD: -36 percent (substantially better than average)

- Ford F-150 SuperCrew: -27 percent (better than average)

- Ford F-150 SuperCrew 4WD: -28 percent (better than average)

These numbers are in the negative, which is better than average. This also means you could have a lower rate for collision insurance if you drive a Ford F-150.

The comprehensive losses are also good for this pickup truck, though not as great as the collision losses. See the details below.

- Ford F-150: -41 percent (substantially better than average)

- Ford F-150 4WD: -35 percent (substantially better than average)

- Ford F-150 SuperCab: -18 percent (average)

- Ford F-150 SuperCab 4WD: -21 percent (better than average)

- Ford F-150 SuperCrew: -6 percent (average)

- Ford F-150 SuperCrew 4WD: 2 percent (average)

Once again, the different F-150 models all scored average or better than average in this category. Your comprehensive insurance rates might also be lower than average as a result.

Because the insurance claims are so low for the Ford F-150, you could have a lower overall rate if you don’t have a poor driving history.

What are the theft rates of the Ford F-150?

One factor that may increase your comprehensive rates slightly is theft. Cars that are stolen more often will have more comprehensive claims filed.

The National Insurance Crime Bureaus’ 2018 report found that full-size Ford pickups rank third in the top ten stolen vehicles in the U.S. In 2018, criminals stole 36,355 full-size Ford Pickups. The most popular stolen model year was 2006, as there were 3,173 stolen.

Most of the most popular model years on the list of top stolen vehicles are older models, as older cars are easier to steal. They have less anti-theft protection, which makes them easier targets. So if you own an older year of the Ford F-150, your vehicle could be at a greater risk of being stolen.

How much will it cost to repair my Ford F-150?

Have you ever dropped your car off for a routine inspection, only to be hit with a high bill because your brakes were poor, your engine was malfunctioning, and other unexpected problems? Not being prepared for what repairs cost on your Ford F-150 can make it hard to budget.

While insurers won’t care about regular maintenance, as you are paying for this, they care about repair costs after an accident. According to our quote from the InstantEstimator’s free online tool, level two damage repairs for a 2020 Ford F-150 crew cab will amount to the following:

- Front bumper: $389

- Rear bumper: $399

- Hood: $411

- Roof: $459

- Front door: $403

- Back door: $391

- Fender: $363

- Quarter panel: $411

These estimates are based on paint and body labor, painting supplies, hazardous waste disposal, and paint/sand/buff. These prices look normal, which means the Ford F-150 won’t be expensive to repair. This makes sense, as the Ford F-150 is mass-produced by a popular manufacturer, so parts and paint will be easier to find.

We want to point out that the color of your car won’t impact your insurance rates. Some people think that red trucks are more expensive to insure, but a flashy color doesn’t mean higher rates. If the paint color is discontinued or custom-mixed, you may notice your repair bill is higher than normal.

You are now an expert on securing cheap Ford F-150 car insurance quotes. Remember, your Ford F-150 insurance costs will vary depending on where you live, your driving record, and your model’s age and trim level.

Did our guide answer all your questions about Ford F-150 rates? Are you ready to find a Ford F-150 car insurance company?

We hope that you have a better understanding of what rates you should be paying, so you can jump right into getting comparison quotes and finding cheap car insurance.

Before you buy Ford F-150 car insurance, shop around for the best rates by comparing quotes from multiple companies. Find a provider that offers you competitive rates without compromising your coverage levels.

Want to get started on comparing rates for a Ford F-150? Enter your ZIP code into our FREE rate comparison tool, and you can compare affordable Ford F-150 auto insurance quotes from companies in your area.

Frequently Asked Questions

What are the average Ford F-150 car insurance rates?

The national average to insure a Ford F-150 is $112 per month, with variations in rates depending on the state and trim level of the vehicle.

How does the size and class of the Ford F-150 affect liability rates?

The size and class of the Ford F-150 can affect liability rates as larger and more powerful vehicles have a higher potential for causing damage in accidents. However, other factors such as insurance loss history also play a role in determining liability rates.

What does liability insurance cost for the Ford F-150?

The cost of liability insurance for the Ford F-150 can vary depending on factors such as coverage levels and the driver’s profile. As an example, for a 2020 Ford F-150 regular cab, the cost to upgrade from low to high coverage ranges from $12 to $19 per month.

What are the safety features and ratings of the Ford F-150?

The Ford F-150 comes equipped with various safety features, including airbags and stability control systems. It has also received good ratings in crash tests conducted by organizations such as the Insurance Institute for Highway Safety (IIHS) and the National Highway Traffic Safety Administration (NHTSA).

What is the MSRP of the Ford F-150?

The manufacturer’s suggested retail price (MSRP) for the Ford F-150 can vary depending on the specific model and year. As an example, the MSRP for a 2020 Ford F-150 regular cab ranges from $28,745 to $37,240, with the fair purchase price typically being around $2,000 lower than the MSRP.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2026

- Cheapest Jeep Insurance Rates in 2026

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Dodge Grand Caravan Insurance

- Ford F-150 Insurance

- Chevrolet Silverado Insurance

- Dodge Ram Insurance

- Toyota Camry Insurance

- Hyundai Santa Fe Insurance

- Kia Optima Insurance

- Toyota Corolla Insurance

- Honda CR-V Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area