How much does car insurance cost?

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jul 8, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

If you’re buying a new (or different) vehicle, or have never purchased a car before, one of the top questions you may have is how much is insurance going to cost?

There are a ton of factors that determine your insurance bottom line, and we will break down the top price factors in this article. But first, let’s take a look at the average cost of car insurance for a 40-year-old male driver who is a good driver, qualifies for good driver and claim-free discounts, and has $500 physical damage insurance deductibles. The rated vehicle is a new Ford Fusion, which overall has fairly average rates for passenger sedans.

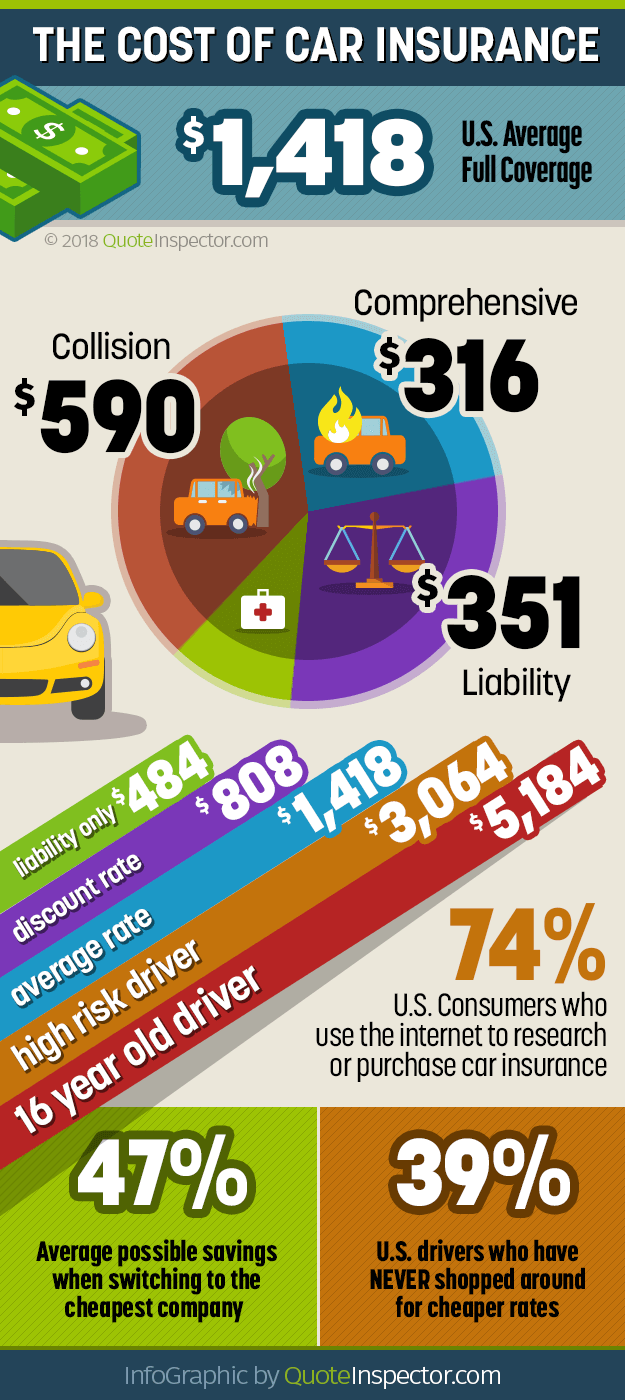

For this example driver and vehicle, car insurance costs approximately $1,418 per year for full coverage. That cost breaks down by coverage type to $316 for comprehensive insurance, $590 for collision insurance, and $351 for liability insurance. The remaining premium consists of uninsured and under-insured motorist coverage, medical or PIP, and policy fees.

Top Five Factors Impacting Car Insurance Cost

Obviously, not every driver is going to fall into the same age or risk category, nor is the rated vehicle going to be identical. There are many different things that can impact the price on your auto insurance policy, but let’s take a look at the top five factors that can affect car insurance rates the most.

Where You Live

One of the largest factors that has an impact on how much car insurance costs is where you live. All states have different laws that affect the price of car insurance, and some states have higher incidents of claims which can drive up the cost.

Some states use a ‘no-fault’ liability insurance system, which can help prevent injury litigation, but it can also cause higher insurance rates due to insurance companies being required to pay claims regardless of fault.

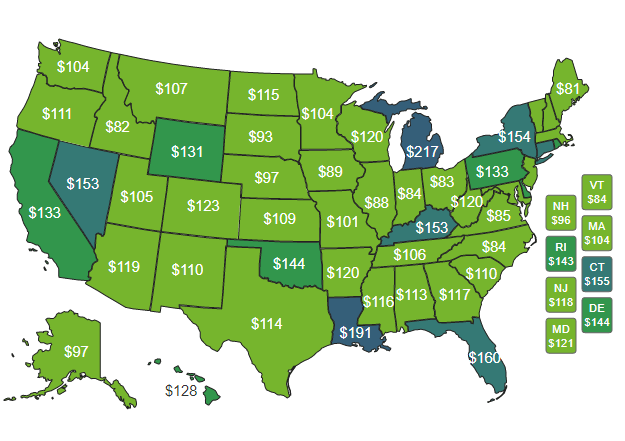

The map below shows the average cost of car insurance in all 50 states for your average passenger sedan.

Monthly Car Insurance Cost by State

States like Michigan, New York, Louisiana, and other darker-shaded states tend to have higher overall car insurance rates. If you’re lucky enough to live in a state that has sub-$100 per month car insurance costs like Idaho, South Dakota, Ohio, or Vermont, you’re going to pay some of the cheapest rates in the country.

The Type of Vehicle You Drive

One of the biggest things that affect the cost is the make and model of car, truck, or SUV that you drive.

More expensive models and trim levels cost more to repair or replace, so premium rates will naturally be higher for vehicles like a Lexus LS 460, Audi S8 4.0T Plus, or a BMW ALPINA B7 xDrive.

High performance sports cars have a higher likelihood of liability claims and expensive repairs, so models like a Chevy Corvette Z06, Acura NSX, or Ford GT with have high car insurance costs to go along with the high purchase price.

If you’re like the rest of us who cannot afford those types of vehicles and prefer a more modest ride, the table below shows average insurance rates for a variety of popular vehicles.

| Make and Model | Annual Premium | Monthly Premium |

|---|---|---|

| Chevrolet Silverado | $1,484 | $124 |

| Dodge Ram | $1,524 | $127 |

| Ford Escape | $1,170 | $98 |

| Ford Focus | $1,358 | $113 |

| Ford Fusion | $1,492 | $124 |

| Ford F-150 | $1,322 | $110 |

| GMC Acadia | $1,294 | $108 |

| GMC Sierra | $1,460 | $122 |

| Honda Accord | $1,310 | $109 |

| Honda Civic | $1,536 | $128 |

| Honda CR-V | $1,140 | $95 |

| Honda Pilot | $1,336 | $111 |

| Hyundai Sonata | $1,426 | $119 |

| Kia Optima | $1,454 | $121 |

| Nissan Altima | $1,446 | $121 |

| Nissan Rogue | $1,412 | $118 |

| Toyota Camry | $1,432 | $119 |

| Toyota Corolla | $1,400 | $117 |

| Toyota Prius | $1,306 | $109 |

| Toyota RAV4 | $1,324 | $110 |

| Get Rates for Your Vehicle Go | ||

The table above demonstrates that the cheapest vehicles to insure are safer, smaller, and lower-cost than the more expensive vehicles. They generally have very good safety ratings and the purchase price is reasonable. Larger vehicles generally cost more and also tend to have higher costs for property damage liability insurance.

Your Choice of Insurance Company

The insurance company you choose can have a significant impact on your rates. Rates vary a lot between companies, even within the same state. Some companies have a higher tolerance for risk than others, and those companies will often be good choices for drivers who may have a couple of tickets or an accident or two.

The four largest car insurance companies in the U.S. are State Farm, Allstate, Progressive, and Geico. Between them, they insure over half of all vehicles insured in America. The table below ranks them based on different criteria, and shows some of the optional policy coverages available from each.

| State Farm | Allstate | Progressive | Geico | |

|---|---|---|---|---|

| Discounts Offered | 3rd | 1st | 4th | 2nd |

| Claims Service | 2nd | 1st | 4th | 3rd |

| Client Services | 4th | 2nd | 3rd | 1st |

| U.S. market share | 18.3% | 10% | 8.8% | 11.4% |

| A.M. Best rating | A++ | A+ | A+ | A++ |

| Rate for vehicle usage | Yes | Yes | Yes | No |

| Accident forgiveness | No | Yes | Yes | Yes |

| Uber and Lyft insurance | Yes | Yes | Yes | Yes |

| Emergency roadside service | Yes | Yes | Yes | Yes |

| New car replacement | No | Yes | No | No |

| Breakdown insurance | No | No | Yes | Yes |

| Compare Prices Go | ||||

The Coverages You Choose

Drivers have many coverage options when it comes to buying car insurance. They can go with a basic liability-only policy, add in comprehensive and collision for full coverage, and even add optional coverages like replacement cost coverage, towing and roadside assistance, higher limits for custom paint or wheels, and even medical coverage for pets if injured in an accident.

Higher liability limits, lower deductibles for physical damage coverage, and more optional coverages, all contribute to a higher auto insurance bill.

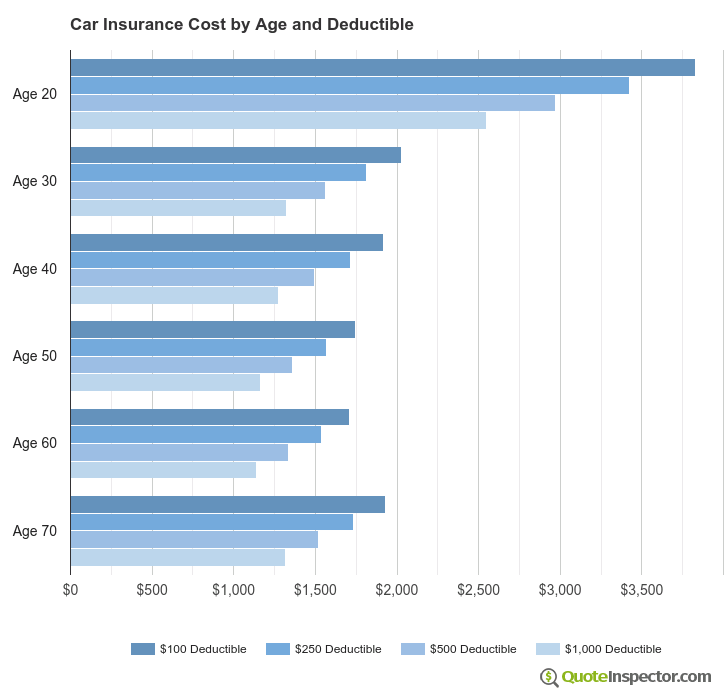

If you buy full coverage, the deductibles you buy on your policy will have the greatest impact on how much you pay. A deductible applies to both comprehensive (also called ‘Other Than Collision’ or OTC) and collision coverage, and is the amount of money you have to pay out of pocket if you have a claim.

Deductibles range from anywhere from $100 up to $1,500, but each company has their own specific amounts and you may find policies offering both higher and lower amounts. Low deductibles will cost you more money, as that means the insurance company will have to pay more of a claim. High deductibles save money, because you are shouldering more of the claim payment.

The chart below demonstrates the cost difference between $100, $250, $500, and $1,000 deductibles for different age groups.

As demonstrated by the chart, a 30-year-old driver could lower their car insurance rates from $1,924 a year with a $100 deductible down to $1,260 a year with a $1,000 deductible. That’s a savings of $664 a year or 35%.

Drivers who do not file many claims may save money in the long run by choosing the higher deductible. But insureds need to have an adequate amount of savings to be able to pay the higher deductible in the event of a claim.

Your Driving Record

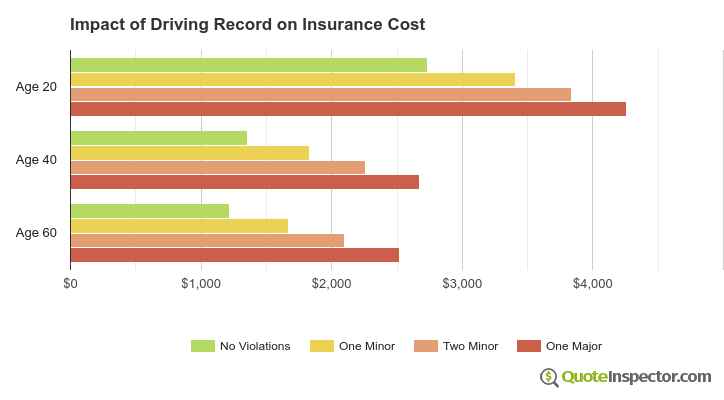

The last factor that can have a major impact on insurance rates is your driving record, or motor vehicle report. If you have a tendency to get speeding tickets or have at-fault accidents, you will definitely pay more to insure your vehicle.

The chart below shows the difference in car insurance rates for drivers of various ages with a clean driving record, after receiving one and two minor violations, and after receiving one major conviction like a DUI, reckless driving, or driving on a suspended or revoked license.

In this example, the average cost of an auto insurance policy per year with no accidents and a clean driving record is $1,294 a year. Receiving two speeding tickets causes the cost to jump to $2,142, an increase of $848 each year, or $71 a month.

Drivers with major violations are considered higher risk than the average driver, and they will pay much higher rates even with just one conviction. Receive multiple major violations and your policy will likely be non-renewed and you will have to find coverage in the high-risk or ‘non-standard’ market.

Additional Rate Tables and Cost Comparisons

The tables below show how the rate you pay varies based on things like driver age, physical damage deductibles, policy liability limits, driver risk, and potential price discounts from your company.

Rates by Driver Age

Young drivers pay much higher rates than older, more experience drivers. The table below shows estimated insurance costs for different driver ages.

| Driver Age | Premium |

|---|---|

| 16 | $5,184 |

| 20 | $3,270 |

| 30 | $1,486 |

| 40 | $1,418 |

| 50 | $1,290 |

| 60 | $1,266 |

Full coverage, 40-year-old male driver, $500 deductibles

Rates by Deductible

Full coverage consists of both comprehensive and collision insurance, and a separate deductible is set for each coverage. This table shows cost estimates based on different deductible selections.

| Deductible | Premium |

|---|---|

| $100 | $1,820 |

| $250 | $1,634 |

| $500 | $1,418 |

| $1,000 | $1,212 |

Rates based on 40-year-old male driver with clean driving record

Rates by Liability Limit

Drivers can buy different levels of liability coverage, with each state having a specific minimum requirement. The table below shows rate estimates at different liability coverage amounts.

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,418 |

| 50/100 | $1,545 |

| 100/300 | $1,633 |

| 250/500 | $1,863 |

| 100 CSL | $1,580 |

| 300 CSL | $1,775 |

| 500 CSL | $1,917 |

Full coverage, male driver age 40, $500 deductibles

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Rates for High Risk Drivers

High-risk drivers pay the highest insurance rates with the exception of teenage drivers. Teen drivers with violations and/or at-fault accidents will pay incredibly high premiums.

| Age | Premium |

|---|---|

| 16 | $7,414 |

| 20 | $5,200 |

| 30 | $3,138 |

| 40 | $3,064 |

| 50 | $2,922 |

| 60 | $2,892 |

Full coverage 40-year-old male driver, $500 deductibles, two speeding tickets, and one at-fault accident

Potential Rate Discounts

Without a doubt, having to make a claim can add to the stress in our lives. But for those who don’t have any claims on their driving record? They may be entitled to a discount.

Insurance companies offer many discounts for things like being a good driver, being claim-free, bundling your policies, and quoting early and online. The more discounts you qualify for, the cheaper your rates will be.

| Discount | Savings |

|---|---|

| Multi-policy | $76 |

| Multi-vehicle | $73 |

| Homeowner | $20 |

| 5-yr Accident Free | $108 |

| 5-yr Claim Free | $92 |

| Paid in Full/EFT | $68 |

| Advance Quote | $72 |

| Online Quote | $101 |

| Total Discounts | $610 |

All the rates shown in this article are based on the average rate of $1,418 for a 40-year-old driver, so a driver who qualifies for all the discounts shown above could save $610 a year and pay only $808 annually for full coverage.

Not every company offers the same discounts, and some of the discounts shown above may not be offered in every state. Your particular company may offer additional discounts for things like professional memberships, occupational organizations, active military, and much more.

It’s important to check with your agent or company to ensure you’re receiving all the discounts you qualify for. Some are easily missed and it’s savings that you’re entitled to, so it can pay to ask about it.

How to Save Money on Car Insurance

Now that you know the biggest factors that cause expensive car insurance rates, here are some tips on how to keep rates affordable.

- Drive safe and keep your driving record clean. At-fault accidents and traffic violations are the biggest controllable factors that result in high rates.

- Buy vehicles with good IIHS safety ratings. A good safety rating means less likelihood of passenger injuries in a crash, which means lower liability and medical/PIP rates.

- Only buy optional coverages that you really need. If you do not travel a lot with your vehicle, or you have an extra household vehicle, roadside assistance or rental reimbursement coverage may not be necessary.

- Consider raising your policy deductibles or eliminating full coverage all together if your vehicle is nearing 10 years old or when the annual cost of full coverage exceeds 10% of your vehicle’s actual cash value.

- Shop around with reputable insurance companies. Smart shoppers make a habit of comparing rates at least every other year. Insurance costs are dynamic and change regularly, so don’t get stuck with an overpriced policy when there are plenty of cheaper alternatives.

Drivers have a lot of options when it comes to buying car insurance, and it’s important to compare rates every year or two to make sure you’re not overpaying. Companies change rates regularly and if you do not pay attention to your bill, you may find that cheap rate you had a few years ago is now quite expensive compared to the competition.

Case Studies: Understanding Car Insurance Rates

Case Study 1: The Influence of Marital Status

John gets married and adds his spouse to his car insurance policy. As a result, his premium decreases by 10%. Insurance companies often offer lower rates to married couples based on statistical data that shows married individuals are generally more responsible drivers.

Case Study 2: The Role of Annual Mileage

Sarah changes jobs and now has a shorter commute, reducing her annual mileage from 15,000 to 8,000 miles. As a result, her car insurance premium decreases by 15%. Insurance companies consider lower mileage as an indicator of reduced exposure to accidents and adjust rates accordingly.

Case Study 3: The Impact of a Safety Device

Mark installs an anti-theft device in his vehicle. Due to the added security measure, his car insurance premium decreases by 5%. Insurance companies offer discounts for safety devices that reduce the risk of theft or accidents, making the vehicle less vulnerable to potential claims.

Frequently Asked Questions

How is car insurance cost determined?

Car insurance cost is determined by various factors, including your age, gender, location, driving history, type of vehicle, coverage options, and insurance company policies. Insurance companies assess these factors to calculate the risk associated with insuring you and provide you with a premium quote.

What is the average cost of car insurance?

The average cost of car insurance varies widely depending on multiple factors, including your location and personal circumstances. It is difficult to provide an exact average cost that applies universally. However, in the United States, the average annual cost of car insurance for a typical driver is approximately $1,000 to $1,500.

What factors can affect the cost of car insurance?

Several factors can influence the cost of car insurance, such as:

- Age and gender: Younger and inexperienced drivers typically face higher premiums, while older drivers may receive lower rates. Additionally, males often have higher premiums compared to females.

- Driving record: Drivers with a history of accidents, traffic violations, or DUI offenses are considered higher risk, resulting in higher premiums.

- Location: Insurance costs can vary significantly depending on where you live. Areas with higher population density, more traffic congestion, or higher crime rates may have higher premiums.

- Vehicle type: Expensive or high-performance cars may have higher insurance costs due to increased repair or replacement costs.

- Coverage options: The type and amount of coverage you choose impact your premium. More extensive coverage or lower deductibles may result in higher costs.

- Credit history: In some states and countries, insurers may consider your credit history when determining premiums.

- Insurance company: Each insurance company has its own pricing structure and policies, so rates can vary between providers.

How can I get a more accurate car insurance quote?

To get a more accurate car insurance quote, it’s recommended to gather specific details about your driving history, vehicle information, and coverage preferences before contacting insurance providers. Additionally, you can use online quote comparison tools or consult with insurance agents to receive personalized quotes based on your individual circumstances.

Are there ways to reduce car insurance cost?

Yes, there are several strategies to potentially reduce car insurance costs:

- Shop around: Compare quotes from multiple insurance companies to find the best rate.

- Increase deductibles: Opting for higher deductibles can lower your premium, but be sure you can afford the out-of-pocket costs in case of a claim.

- Bundle policies: Consider bundling your car insurance with other policies like homeowners or renters insurance to potentially receive a discount.

- Maintain a good driving record: Avoid accidents and traffic violations to maintain a clean driving record, which can lead to lower premiums over time.

- Take advantage of discounts: Inquire about available discounts, such as good student discounts, safe driver discounts, or discounts for safety features in your vehicle.

- Consider usage-based insurance: Some insurance companies offer usage-based insurance programs where your premium is based on your actual driving habits, potentially resulting in lower rates for safe drivers.

Can I get a car insurance quote without providing personal information?

While it’s common for insurance providers to request personal information to generate an accurate quote, some online quote comparison tools allow you to obtain estimates without providing personal details. However, keep in mind that these estimates may not be as precise as quotes based on your specific circumstances. If you want a more accurate quote, it’s advisable to provide the necessary personal information when contacting insurance companies directly or using their online quote forms.

Do car insurance costs vary by state?

Yes, car insurance costs can vary significantly by state. Each state has its own regulations, coverage requirements, and factors that impact insurance premiums. Factors such as population density, traffic patterns, average costs of claims, and state-specific laws can contribute to the variation in car insurance costs. It’s important to consider the specific regulations and market conditions in your state when determining insurance costs.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2026

- Cheapest Jeep Insurance Rates in 2026

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Subaru Outback Insurance

- Honda Accord Insurance

- Hyundai Sonata Insurance

- Dodge Ram Insurance

- Toyota Camry Insurance

- Toyota Corolla Insurance

- Nissan Rogue Insurance

- Jeep Wrangler Insurance

- Ford F-150 Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area