Chevrolet Silverado 3500HD LT Crew Cab 2WD Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

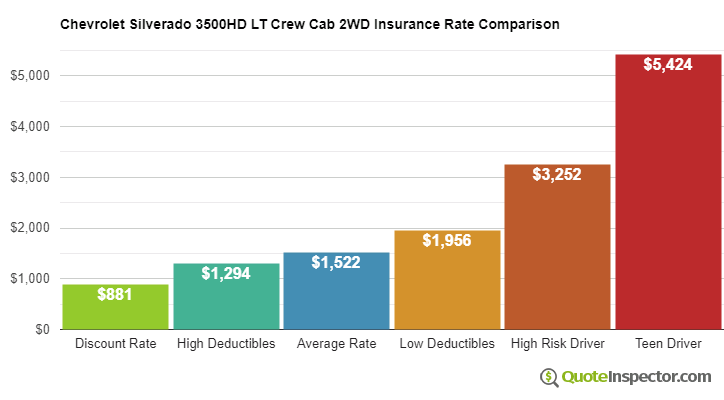

The average insurance prices for a Chevrolet Silverado 3500HD LT Crew Cab 2WD are $1,522 every 12 months for full coverage insurance. Comprehensive costs an estimated $396, collision insurance costs $604, and liability costs around $364. Buying just liability costs as low as $430 a year, and insurance for high-risk drivers costs around $3,252. Teenage drivers cost the most to insure at up to $5,424 a year.

Annual premium for full coverage: $1,522

Policy rates broken down by type of insurance:

40-year-old driver, full coverage with $500 deductibles, and good driving record

Price Range for Insurance for this Chevrolet Silverado 3500HD Trim Level

For an average driver, Chevrolet Silverado 3500HD LT Crew Cab 2WD insurance rates range from the cheapest price of $430 for liability-only coverage to a much higher rate of $3,252 for a driver required to buy high-risk insurance.

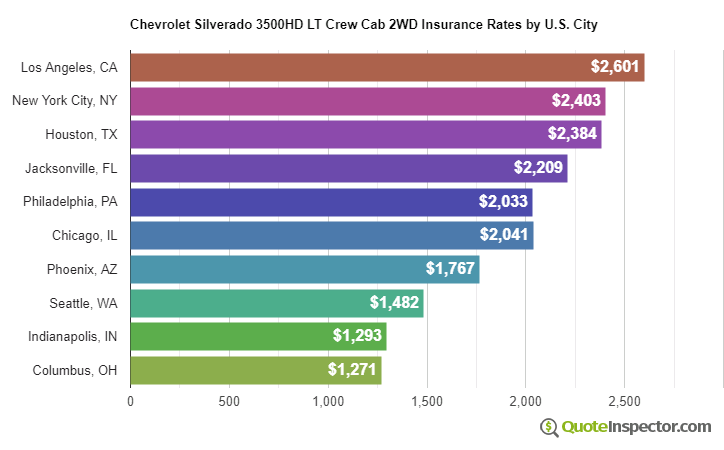

Urban vs. Rural Price Range

Where you live can make a big difference on the price of insurance. More rural locations are shown to have more infrequent physical damage claims than densely populated cities. The price range example below illustrates the effect of geographic area on insurance prices.

These price differences illustrate why anyone shopping for car insurance should compare prices for a targeted area and their own driving history, instead of making a decision based on average rates.

Use the form below to get rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Companies with Cheap Chevrolet Silverado 3500HD LT Crew Cab 2WD Insurance

Insurance rates for a Chevrolet Silverado 3500HD LT Crew Cab 2WD also range considerably based on liability limits and deductibles, your risk profile, and the model year.

Using high physical damage deductibles could cut rates by as much as $670 annually, while increasing your policy's liability limits will increase premiums. Switching from a 50/100 liability limit to a 250/500 limit will raise rates by up to $327 more per year. View Rates by Deductible or Liability Limit

An older driver with a clean driving record and higher deductibles may pay as low as $1,400 a year, or $117 per month, for full coverage. Rates are much higher for teenagers, since even excellent drivers can expect to pay at least $5,400 a year. View Rates by Age

If you have a few points on your driving record or you were responsible for an accident, you are probably paying $1,800 to $2,400 extra every year, depending on your age. High-risk driver insurance can be from 44% to 133% more than a normal policy. View High Risk Driver Rates

Your home state has a huge impact on Chevrolet Silverado 3500HD LT Crew Cab 2WD insurance prices. A driver around age 40 might see rates as low as $1,180 a year in states like , , and North Carolina, or be forced to pay as much as $1,800 on average in California, Montana, and Michigan. Rates by state and city are shown later in the article.

Because rates have so much variability, the only way to figure out who has the best car insurance rates is to compare rates from multiple companies. Each insurance company uses a different method to calculate rates, so the rates will be varied.

The chart estimates Chevrolet Silverado 3500HD LT Crew Cab 2WD insurance rates for various coverage choices and risks. The cheapest discount rate is $881. Drivers who use higher $1,000 deductibles will pay $1,294. The average rate for a driver around age 40 using $500 deductibles is $1,522. Using more expensive $100 deductibles for physical damage coverage could cost up to $1,956. Drivers with multiple violations and accidents could be charged around $3,252. The price for full coverage insurance for a teenage driver can be as high as $5,424.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $1,376 | -$146 | -9.6% |

| Alaska | $1,166 | -$356 | -23.4% |

| Arizona | $1,262 | -$260 | -17.1% |

| Arkansas | $1,522 | -$0 | 0.0% |

| California | $1,734 | $212 | 13.9% |

| Colorado | $1,454 | -$68 | -4.5% |

| Connecticut | $1,564 | $42 | 2.8% |

| Delaware | $1,722 | $200 | 13.1% |

| Florida | $1,904 | $382 | 25.1% |

| Georgia | $1,406 | -$116 | -7.6% |

| Hawaii | $1,094 | -$428 | -28.1% |

| Idaho | $1,028 | -$494 | -32.5% |

| Illinois | $1,134 | -$388 | -25.5% |

| Indiana | $1,144 | -$378 | -24.8% |

| Iowa | $1,028 | -$494 | -32.5% |

| Kansas | $1,446 | -$76 | -5.0% |

| Kentucky | $2,074 | $552 | 36.3% |

| Louisiana | $2,252 | $730 | 48.0% |

| Maine | $938 | -$584 | -38.4% |

| Maryland | $1,254 | -$268 | -17.6% |

| Massachusetts | $1,216 | -$306 | -20.1% |

| Michigan | $2,644 | $1,122 | 73.7% |

| Minnesota | $1,272 | -$250 | -16.4% |

| Mississippi | $1,822 | $300 | 19.7% |

| Missouri | $1,350 | -$172 | -11.3% |

| Montana | $1,634 | $112 | 7.4% |

| Nebraska | $1,200 | -$322 | -21.2% |

| Nevada | $1,824 | $302 | 19.8% |

| New Hampshire | $1,096 | -$426 | -28.0% |

| New Jersey | $1,700 | $178 | 11.7% |

| New Mexico | $1,346 | -$176 | -11.6% |

| New York | $1,602 | $80 | 5.3% |

| North Carolina | $878 | -$644 | -42.3% |

| North Dakota | $1,246 | -$276 | -18.1% |

| Ohio | $1,050 | -$472 | -31.0% |

| Oklahoma | $1,562 | $40 | 2.6% |

| Oregon | $1,392 | -$130 | -8.5% |

| Pennsylvania | $1,452 | -$70 | -4.6% |

| Rhode Island | $2,028 | $506 | 33.2% |

| South Carolina | $1,378 | -$144 | -9.5% |

| South Dakota | $1,282 | -$240 | -15.8% |

| Tennessee | $1,332 | -$190 | -12.5% |

| Texas | $1,834 | $312 | 20.5% |

| Utah | $1,128 | -$394 | -25.9% |

| Vermont | $1,040 | -$482 | -31.7% |

| Virginia | $912 | -$610 | -40.1% |

| Washington | $1,176 | -$346 | -22.7% |

| West Virginia | $1,396 | -$126 | -8.3% |

| Wisconsin | $1,054 | -$468 | -30.7% |

| Wyoming | $1,356 | -$166 | -10.9% |

Rate Tables and Charts

Not your model?

Choose a different trim level below

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $5,424 |

| 20 | $3,448 |

| 30 | $1,598 |

| 40 | $1,522 |

| 50 | $1,384 |

| 60 | $1,356 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,956 |

| $250 | $1,758 |

| $500 | $1,522 |

| $1,000 | $1,294 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,522 |

| 50/100 | $1,595 |

| 100/300 | $1,686 |

| 250/500 | $1,922 |

| 100 CSL | $1,631 |

| 300 CSL | $1,831 |

| 500 CSL | $1,977 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $7,756 |

| 20 | $5,468 |

| 30 | $3,336 |

| 40 | $3,252 |

| 50 | $3,096 |

| 60 | $3,064 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $82 |

| Multi-vehicle | $75 |

| Homeowner | $21 |

| 5-yr Accident Free | $112 |

| 5-yr Claim Free | $97 |

| Paid in Full/EFT | $71 |

| Advance Quote | $74 |

| Online Quote | $109 |

| Total Discounts | $641 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area