Audi A5 Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

When the time comes to figure out how much Audi A5 insurance costs, you might be left with more questions than answers. In order to streamline your search for a quality provider and help you determine if you should have full coverage or liability alone, we have prepared this in-depth guide.

This article will inform you about average insurance rates for the Audi A5, how the size and class of the vehicle play a factor, what liability insurance costs for the Audi A5, its safety features, MSRP value, and repair estimates.

By the time you have finished reading through this piece, you will be better equipped to find the right insurance provider for a good rate. In fact, you can start comparing quotes right now by taking advantage of our free online quote tool.

Average insurance rates for an Audi A5 are $1,070 a year with full coverage. Comprehensive costs approximately $206, collision costs $326, and liability is $402. Liability-only coverage costs around $446 a year, with high-risk coverage costing around $2,312. Teenage drivers receive the highest rates at $4,124 a year or more.

Average premium for full coverage: $1,070

Rate estimates by individual coverage type:

Rate estimates include $500 policy deductibles, liability limits of 30/60, and includes additional medical/uninsured motorist coverage. Rates are averaged for all U.S. states and for different A5 trim levels.

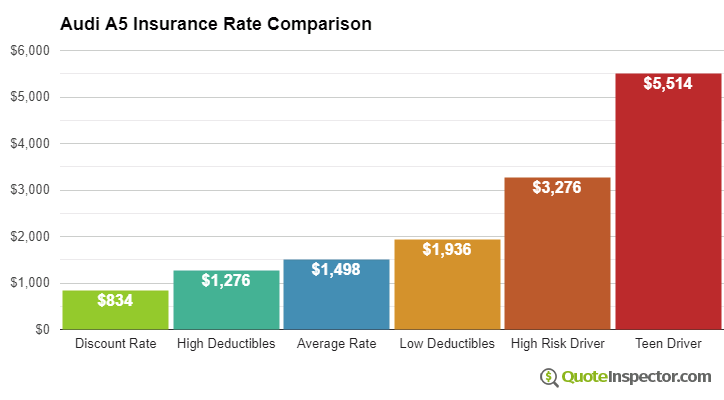

Price Range by Coverage and Risk

Using a 40-year-old driver as an example, prices range go from the low end price of $446 for just the minimum liability insurance to a much higher rate of $2,312 for a driver that may need high-risk insurance.

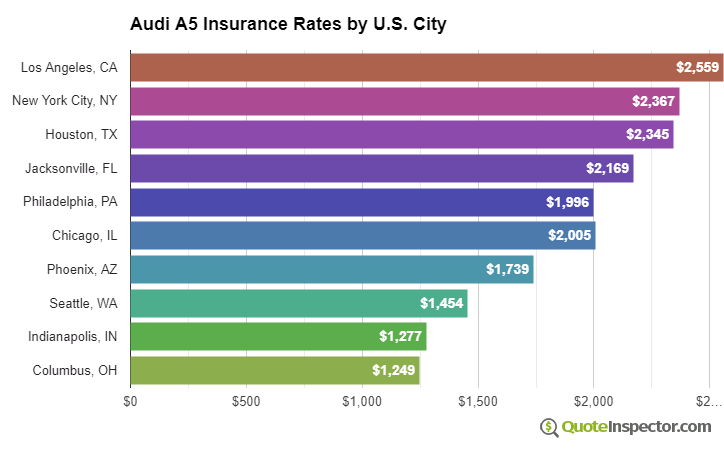

Price Range by Location

Choosing to live in a large city can make a big difference on the price of insurance. Rural locations tend to have lower incidents of collision claims than densely populated cities.

The price range example below illustrates how rural and urban location affects auto insurance prices.

These examples demonstrate why anyone shopping for car insurance should compare rates quotes using their specific location, instead of making a decision based on average rates.

Use the form below to get customized rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Additional Rate Analysis

The chart below details estimated Audi A5 insurance rates for additional coverage and risk scenarios.

- The best discount rate is $629

- Raising to $1,000 deductibles will save $122 annually

- The estimated price for a 40-year-old driver who chooses $500 deductibles is $1,070

- Using more expensive low deductibles bumps up the cost to $1,304

- Drivers who are prone to accidents and violations could pay around $2,312 or more

- The cost that insures a 16-year-old driver with full coverage can cost $4,124

Car insurance rates for an Audi A5 can also vary considerably based on the model year and trim level, your age and driving habits, and physical damage deductibles and liability limits.

If you like to drive fast or you caused an accident, you may be forking out anywhere from $1,300 to $1,800 extra per year, depending on your age. High-risk driver insurance is expensive and can cost from 44% to 135% more than a normal policy. View High Risk Driver Rates

An older driver with no driving violations and higher comprehensive and collision deductibles may pay as low as $1,000 every 12 months on average for full coverage. Rates are much higher for teen drivers, since even teens with perfect driving records will be charged in the ballpark of $4,100 a year. View Rates by Age

Where you live also has a big influence on Audi A5 insurance prices. A middle-age driver might find rates as low as $770 a year in states like Utah, Ohio, and New Hampshire, or be forced to pay as much as $1,440 on average in New York, Michigan, and Florida.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $968 | -$102 | -9.5% |

| Alaska | $820 | -$250 | -23.4% |

| Arizona | $888 | -$182 | -17.0% |

| Arkansas | $1,070 | -$0 | 0.0% |

| California | $1,218 | $148 | 13.8% |

| Colorado | $1,020 | -$50 | -4.7% |

| Connecticut | $1,100 | $30 | 2.8% |

| Delaware | $1,208 | $138 | 12.9% |

| Florida | $1,334 | $264 | 24.7% |

| Georgia | $990 | -$80 | -7.5% |

| Hawaii | $768 | -$302 | -28.2% |

| Idaho | $726 | -$344 | -32.1% |

| Illinois | $798 | -$272 | -25.4% |

| Indiana | $808 | -$262 | -24.5% |

| Iowa | $720 | -$350 | -32.7% |

| Kansas | $1,016 | -$54 | -5.0% |

| Kentucky | $1,458 | $388 | 36.3% |

| Louisiana | $1,584 | $514 | 48.0% |

| Maine | $660 | -$410 | -38.3% |

| Maryland | $884 | -$186 | -17.4% |

| Massachusetts | $854 | -$216 | -20.2% |

| Michigan | $1,858 | $788 | 73.6% |

| Minnesota | $896 | -$174 | -16.3% |

| Mississippi | $1,282 | $212 | 19.8% |

| Missouri | $948 | -$122 | -11.4% |

| Montana | $1,148 | $78 | 7.3% |

| Nebraska | $842 | -$228 | -21.3% |

| Nevada | $1,282 | $212 | 19.8% |

| New Hampshire | $772 | -$298 | -27.9% |

| New Jersey | $1,198 | $128 | 12.0% |

| New Mexico | $946 | -$124 | -11.6% |

| New York | $1,126 | $56 | 5.2% |

| North Carolina | $616 | -$454 | -42.4% |

| North Dakota | $878 | -$192 | -17.9% |

| Ohio | $738 | -$332 | -31.0% |

| Oklahoma | $1,096 | $26 | 2.4% |

| Oregon | $980 | -$90 | -8.4% |

| Pennsylvania | $1,020 | -$50 | -4.7% |

| Rhode Island | $1,426 | $356 | 33.3% |

| South Carolina | $970 | -$100 | -9.3% |

| South Dakota | $904 | -$166 | -15.5% |

| Tennessee | $936 | -$134 | -12.5% |

| Texas | $1,290 | $220 | 20.6% |

| Utah | $792 | -$278 | -26.0% |

| Vermont | $730 | -$340 | -31.8% |

| Virginia | $642 | -$428 | -40.0% |

| Washington | $824 | -$246 | -23.0% |

| West Virginia | $980 | -$90 | -8.4% |

| Wisconsin | $738 | -$332 | -31.0% |

| Wyoming | $954 | -$116 | -10.8% |

Using high physical damage deductibles can reduce rates by up to $360 annually, while increasing your policy's liability limits will push rates upward. Moving from a 50/100 bodily injury protection limit to a 250/500 limit will cost as much as $362 extra every 12 months. View Rates by Deductible or Liability Limit

With so much variability in rates, the best way to find out who has the cheapest auto insurance rates is to compare rates from multiple companies. Every auto insurance company uses a different method to calculate rates, so rate quotes can be significantly different.

Insurance Rates by Trim Level and Model Year

| Model and Trim | Annual Premium | Monthly Premium |

|---|---|---|

| Audi A5 2.0T Quattro Premium 2-Dr Coupe | $1,018 | $85 |

| Audi A5 2.0T Quattro Premium Plus 2-Dr Coupe | $1,036 | $86 |

| Audi A5 2.0T Premium 2-Dr Convertible | $1,152 | $96 |

| Audi A5 2.0T Premium Plus 2-Dr Convertible | $1,152 | $96 |

| Audi A5 2.0T Quattro Prestige 2-Dr Coupe | $1,058 | $88 |

| Audi A5 3.2 Quattro Premium Plus 2-Dr Coupe | $1,058 | $88 |

| Audi A5 3.2 Quattro Prestige 2-Dr Coupe | $1,058 | $88 |

| Audi A5 2.0T Quattro Prestige S-Line 2-Dr Coupe | $1,090 | $91 |

| Audi A5 2.0T Prestige 2-Dr Convertible | $1,192 | $99 |

| Audi A5 2.0T Prestige S-Line 2-Dr Convertible | $1,192 | $99 |

| Audi A5 3.2 Quattro Prestige S-Line 2-Dr Coupe | $1,112 | $93 |

Rates assume 2011 model year, a 40-year-old male driver with no accidents or violations, $500 comprehensive and collision deductibles, minimum liability limits, and uninsured/under-insured motorist coverage included. Rates are for comparison only and are averaged for all 50 U.S. states.

| Model Year | Comprehensive | Collision | Liability | Total Premium |

|---|---|---|---|---|

| 2024 Audi A5 | $372 | $750 | $332 | $1,590 |

| 2023 Audi A5 | $356 | $744 | $338 | $1,574 |

| 2022 Audi A5 | $344 | $726 | $354 | $1,560 |

| 2021 Audi A5 | $332 | $696 | $364 | $1,528 |

| 2020 Audi A5 | $314 | $672 | $376 | $1,498 |

| 2019 Audi A5 | $302 | $624 | $384 | $1,446 |

| 2018 Audi A5 | $290 | $588 | $388 | $1,402 |

| 2017 Audi A5 | $278 | $526 | $390 | $1,330 |

| 2016 Audi A5 | $260 | $484 | $390 | $1,270 |

| 2015 Audi A5 | $250 | $454 | $394 | $1,234 |

| 2014 Audi A5 | $244 | $424 | $402 | $1,206 |

| 2013 Audi A5 | $226 | $394 | $402 | $1,158 |

| 2012 Audi A5 | $220 | $358 | $406 | $1,120 |

| 2011 Audi A5 | $206 | $326 | $402 | $1,070 |

| 2010 Audi A5 | $194 | $296 | $402 | $1,028 |

Rates are averaged for all Audi A5 models and trim levels. Rates assume a 40-year-old male driver, full coverage with $500 deductibles, and a clean driving record.

How to Find the Best Audi A5 Insurance

Saving money on insurance for an Audi A5 consists of being safe and accident-free, having a positive credit history, eliminating unnecessary coverage, and avoiding coverage lapses. Compare prices once a year by getting rate quotes from direct companies like Progressive, GEICO, and Esurance, and also from local insurance agencies.

Below you'll find a brief recap of the data that was raised in the charts and tables above.

- You may be able to save around $130 per year simply by shopping early and online

- Insureds who purchase more liability protection will pay an extra $440 every year to raise from a minimum limit to the 250/500 level

- Youthful drivers pay the highest auto insurance rates, with premiums as much as $344 per month if full coverage is purchased

- Drivers considered higher risk who tend to receive serious violations may have to pay on average $1,240 more per year than a low-risk driver

Now that we have gone into detail about what average Audi A5 insurance rates look like based on age, location, and driving history, you might be curious about other contributing factors that determine rates.

[360_quote_team]

How does the size and class of the Audi A5 affect liability rates?

The Insurance Institute for Highway Safety (IIHS) classifies the Audi A5 as a midsize luxury car. This is important to know because the size of the vehicle you drive ultimately determines how much money you will pay for the most basic form of coverage, which is called auto liability insurance.

Insurance providers will take the size and class of the Audi A5 into consideration when providing you with a quote. They do this because some vehicles are generally safer than others due to their structural design and curb weight.

As a midsize luxury car, the Audi A5 is comparable to models like the Acura TLX or Lincoln MKZ. Liability rates for the Audi A5 are affected by the loss percentages for each model in the class.

The IIHS reports that the Audi A5 has a property damage loss percentage of -49 percent, which is considered highly favorable among the vehicle class. As of the writing of this article, loss ratio data for bodily injury liability was not available.

What does liability insurance cost for an Audi A5?

Now that we know how liability rates are calculated, you are likely curious to know what the actual rates might be based on the level of coverage you want to have.

The following general quotes will show a breakdown of how much bodily injury liability costs for the Audi A5 as an itemized cost on your insurance policy.

- Low ($25,000): $101.43

- Medium ($50,000): $121.53

- High ($100,000): $132.48

While bodily injury liability will pay for the opposing driver’s medical expenses, you will still need to have coverage for any damage you are responsible for causing to their car. That’s where property damage liability insurance comes into play.

Take a look at the following general property damage liability quotes for the Audi A5 based on low to high coverage.

- Low ($25,000): $107.27

- Medium ($50,000): $104.95

- High ($100,000): $107.65

It’s interesting to note that both forms of liability insurance for the Audi A5 fluctuate at a minimal level. Therefore, if you are on the fence between low or high coverage, it won’t impact your wallet too much if you decide to play it safe.

What are the safety features and ratings of the Audi A5?

Luxury automakers like Audi have earned a reputation for including a lot of safety features in their vehicles. Having these equipped in the car you drive often leads to better safety ratings and a more favorable insurance rate.

Take a look at the following list of safety features for the 2020 Audi A5 sourced from AutoBlog.com.

- Anti-Lock Brakes – Also known as ABS, these brakes have sensors that detect when the tire(s) have stopped moving when extreme braking occurs. The ABS system will modify pressure allowing the tire(s) to continue rotating safely.

- Stability Control – This feature automatically senses when the van’s handling limits have been exceeded and reduces engine power and applies select brakes to help prevent the driver from losing control.

- Front-Impact Airbags – This feature serves to protect the heads of the driver and passengers during a front-end crash.

- Side-Impact Airbags – This feature protects the torso area of the driver and passengers during a side-impact collision.

- Knee Airbags – When deployed, these airbags protect the lower extremities of the driver and passengers inside the Audi A5.

- Anti-Whiplash – These head restraints actively react to rear collision forces and cradle the occupants’ head in an effort to reduce the likelihood of a whiplash injury.

- Pretensioners – This feature automatically tightens the seatbelts to place the occupant in the optimal seating position during a collision.

- Anti-Theft Security – This technology anticipates and detects unwanted vehicle intrusion. The vehicle is equipped with an ignition-disable device that will prevent the engine from starting if the correct original manufacturer key is not used.

These safety features go a long way in the event of a collision. However, it’s important to know the fatality statistics for other vehicles like the Audi A5 so you have a full understanding of how this vehicle class compares to the national average.

The IIHS reports that out of 9,736,590 registered midsize cars, a total of 396 road fatalities have been reported for this vehicle class. Broken down, that is a fatality rate of 41 per one million registered people who drive a model like the Audi A5.

Additionally, the impact point of a crash also plays a factor in how fatal an accident can truly be. The following statistics show how many deaths occurred based on where the crash originated.

- Frontal Impact: 7,433 deaths

- Side Impact: 3,568 deaths

- Rear Impact: 834 deaths

- Other (mostly rollovers): 1,303 deaths

Driving is unpredictable in nature, but having knowledge about what can go wrong will only serve to benefit you in the long run. Beyond educating yourself, having the right auto insurance policy is the next step to take to enjoy peace of mind every time you get behind the wheel of your Audi A5.

What is the MSRP of the Audi A5?

The current value of the vehicle you drive is directly tied to the amount of money you can expect to pay for insurance.

As of the writing of this article, Kelley Blue Book (KBB) reports that the MSRP value of a 2019 Audi A5 Premium is $45,195 with a fair market value between $36,997 and $41,498.

If you decide to buy instead of lease a new Audi A5, one thing you might want to consider is getting full coverage. A lot of drivers do this because liability insurance will not pay for any damages sustained to your vehicle.

Two types of coverage you can get to protect your car are collision and comprehensive insurance.

- Collision car insurance is a type of coverage that will pay for any costs associated with repairing or even replacing your vehicle if it gets damaged after colliding with another car or object.

- Comprehensive car insurance protects you from any damage sustained that is outside of your control, such as a bicycle running into your vehicle while it is parked on the street.

When it comes to loss percentages, the Audi A5 has a collision loss percentage of 58 percent and a comprehensive loss percentage of 41 percent. This is considered above average for the vehicle class.

How much will it cost to repair my Audi A5?

One thing that all car-owners have in common is vehicle maintenance. Even though luxury vehicles like the Audi A5 are built to last, you still have to pay for general upkeep and repairs.

Experts from RepairPal estimate that the annual cost of repairs for the Audi A5 is $798 per year. This includes everything from oil changes and tire rotations to major work that is needed following an accident.

Speaking of which, if you ever found yourself in a situation where you have to pay to repair a certain part of the vehicle, the following estimates come courtesy of Instant Estimator:

- Front Bumper: $412.60

- Rear Bumper: $422.60

- Hood: $377.00

- Roof: $426.60

- Front Door: $389.20

- Back Door: $377.80

- Fender: $327.40

- Quarter Panel: $352.20

To this point, we have gone into great detail about Audi A5 insurance and with a little luck, we’ve answered the question, “How much is insurance for an Audi A5?”

However, we still recognize that we might have missed something so we are curious to know, is there anything else you’d like to see us expand upon?

If not, enter your five-digit ZIP code in our online tool to start comparing quotes for free from the industry’s top insurance providers.

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $4,124 |

| 20 | $2,454 |

| 30 | $1,104 |

| 40 | $1,070 |

| 50 | $980 |

| 60 | $962 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,304 |

| $250 | $1,196 |

| $500 | $1,070 |

| $1,000 | $948 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,070 |

| 50/100 | $1,192 |

| 100/300 | $1,293 |

| 250/500 | $1,554 |

| 100 CSL | $1,233 |

| 300 CSL | $1,454 |

| 500 CSL | $1,615 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $5,860 |

| 20 | $3,912 |

| 30 | $2,348 |

| 40 | $2,312 |

| 50 | $2,206 |

| 60 | $2,186 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $56 |

| Multi-vehicle | $57 |

| Homeowner | $17 |

| 5-yr Accident Free | $73 |

| 5-yr Claim Free | $69 |

| Paid in Full/EFT | $44 |

| Advance Quote | $50 |

| Online Quote | $75 |

| Total Discounts | $441 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area