Nissan Maxima Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: May 21, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

When it comes to the average Nissan Maxima insurance rates, expect to pay around $129 per month or $1,550 annually. However, many different factors can impact your overall car insurance costs. For example, insurance providers will consider the age and trim level of your Nissan Maxima, and will even look into safety and crash test results.

While trying to find the right car insurance provider can be confusing and leave you with more questions than answers, read through our brief guide to learn all you need to know about how Nissan Maxima insurance rates are calculated so you can secure cheap car insurance.

For example, if you’re looking to find out how much monthly 2011 Nissan Maxima insurance rates will end up being, it depends on whether you go with full coverage or liability alone. We will provide you with real data surrounding the Nissan Maxima including its car class, safety features, MSRP value, and repair estimates.

Ready to get started? Read through the information in this article to help you understand everything there is to know about Nissan Maxima insurance rates.

When you’re ready, enter your ZIP code into our free quote tool above to start comparing Nissan Maxima insurance quotes immediately.

The average insurance rates for a Nissan Maxima are $1,528 a year for full coverage. Comprehensive costs on average $344, collision costs $610, and liability insurance is $416. Buying just liability costs around $474 a year, with insurance for high-risk drivers costing around $3,310. Teenage drivers cost the most to insure at $5,624 a year or more.

Average premium for full coverage: $1,528

Policy rates by type of insurance:

Price estimates include $500 policy deductibles, 30/60 split liability limits, and includes additional medical/uninsured motorist coverage. Prices are averaged for all states and for different Maxima trim levels.

Price Range Variability

For the normal driver, Nissan Maxima insurance rates go from as low as $474 for just the minimum liability insurance to a much higher rate of $3,310 for a high-risk insurance policy.

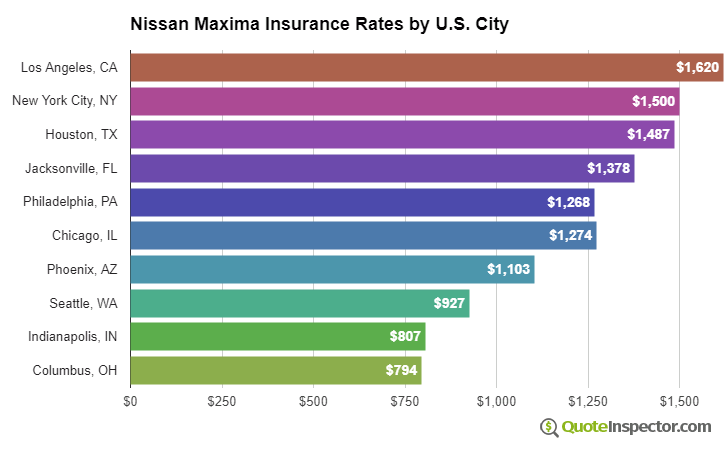

Urban vs. Rural Price Range

Choosing to live in a large city has a significant impact on car insurance rates. Rural areas are shown to have a lower frequency of accident claims than densely populated cities.

The price range example below illustrates how geographic area affects car insurance rates.

The examples above show why anyone shopping for car insurance should compare rates quotes based on a specific location and risk profile, rather than relying on average rates.

Use the form below to get customized rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Additional Rate Analysis

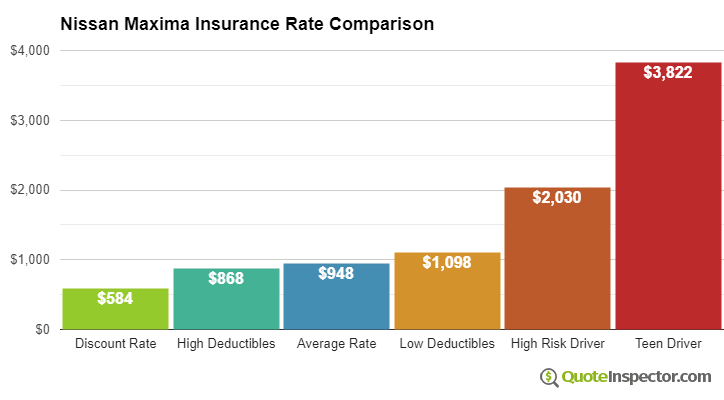

The chart below shows estimated Nissan Maxima insurance rates for different risk profiles and scenarios.

- The best discount rate is $873

- Raising to $1,000 deductibles will save around $216 a year

- The average rate for a good driver age 40 with $500 deductibles is $1,528

- Using more expensive low deductibles will increase the cost to $1,950

- Higher-risk drivers who are prone to accidents and violations could pay upwards of $3,310 or more

- Policy cost for full coverage for a teen driver with full coverage may cost $5,624

Insurance rates for a Nissan Maxima also range considerably based on your risk profile, the trim level of your Maxima, and policy deductibles and limits.

An older driver with a clean driving record and high deductibles could pay as little as $1,400 every 12 months on average, or $117 per month, for full coverage. Rates are much higher for teenagers, where even good drivers can expect to pay upwards of $5,600 a year. View Rates by Age

Your home state also has a big influence on Nissan Maxima insurance rates. A middle-age driver might find rates as low as $1,010 a year in states like Idaho, Maine, and Iowa, or be forced to pay as much as $2,180 on average in Michigan, Louisiana, and New York.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $1,384 | -$144 | -9.4% |

| Alaska | $1,174 | -$354 | -23.2% |

| Arizona | $1,270 | -$258 | -16.9% |

| Arkansas | $1,528 | -$0 | 0.0% |

| California | $1,742 | $214 | 14.0% |

| Colorado | $1,462 | -$66 | -4.3% |

| Connecticut | $1,574 | $46 | 3.0% |

| Delaware | $1,730 | $202 | 13.2% |

| Florida | $1,912 | $384 | 25.1% |

| Georgia | $1,412 | -$116 | -7.6% |

| Hawaii | $1,098 | -$430 | -28.1% |

| Idaho | $1,036 | -$492 | -32.2% |

| Illinois | $1,140 | -$388 | -25.4% |

| Indiana | $1,152 | -$376 | -24.6% |

| Iowa | $1,032 | -$496 | -32.5% |

| Kansas | $1,456 | -$72 | -4.7% |

| Kentucky | $2,086 | $558 | 36.5% |

| Louisiana | $2,264 | $736 | 48.2% |

| Maine | $942 | -$586 | -38.4% |

| Maryland | $1,262 | -$266 | -17.4% |

| Massachusetts | $1,224 | -$304 | -19.9% |

| Michigan | $2,656 | $1,128 | 73.8% |

| Minnesota | $1,280 | -$248 | -16.2% |

| Mississippi | $1,832 | $304 | 19.9% |

| Missouri | $1,358 | -$170 | -11.1% |

| Montana | $1,644 | $116 | 7.6% |

| Nebraska | $1,208 | -$320 | -20.9% |

| Nevada | $1,834 | $306 | 20.0% |

| New Hampshire | $1,102 | -$426 | -27.9% |

| New Jersey | $1,710 | $182 | 11.9% |

| New Mexico | $1,354 | -$174 | -11.4% |

| New York | $1,610 | $82 | 5.4% |

| North Carolina | $882 | -$646 | -42.3% |

| North Dakota | $1,252 | -$276 | -18.1% |

| Ohio | $1,058 | -$470 | -30.8% |

| Oklahoma | $1,570 | $42 | 2.7% |

| Oregon | $1,402 | -$126 | -8.2% |

| Pennsylvania | $1,458 | -$70 | -4.6% |

| Rhode Island | $2,040 | $512 | 33.5% |

| South Carolina | $1,384 | -$144 | -9.4% |

| South Dakota | $1,292 | -$236 | -15.4% |

| Tennessee | $1,340 | -$188 | -12.3% |

| Texas | $1,846 | $318 | 20.8% |

| Utah | $1,134 | -$394 | -25.8% |

| Vermont | $1,048 | -$480 | -31.4% |

| Virginia | $916 | -$612 | -40.1% |

| Washington | $1,184 | -$344 | -22.5% |

| West Virginia | $1,402 | -$126 | -8.2% |

| Wisconsin | $1,058 | -$470 | -30.8% |

| Wyoming | $1,362 | -$166 | -10.9% |

Using high physical damage deductibles can reduce rates by up to $640 each year, while increasing your policy's liability limits will cost you more. Going from a 50/100 limit to a 250/500 limit will raise rates by up to $375 more per year. View Rates by Deductible or Liability Limit

If you have a few points on your driving record or tend to cause accidents, you could be paying at a minimum $1,800 to $2,500 extra every year, depending on your age. High-risk driver insurance is expensive and can cost anywhere from 44% to 132% more than a normal policy. View High Risk Driver Rates

Because rates have so much variability, the only way to know exactly what you will pay is to compare rates from as many companies as possible. Every auto insurance company uses a different method to calculate rates, so the rates will be varied from one company to the next.

Insurance Rates by Trim Level and Model Year

| Model and Trim | Annual Premium | Monthly Premium |

|---|---|---|

| Nissan Maxima 3.5 S | $1,488 | $124 |

| Nissan Maxima 3.5 SV | $1,528 | $127 |

Rates assume 2023 model year, a 40-year-old male driver with no accidents or violations, $500 comprehensive and collision deductibles, minimum liability limits, and uninsured/under-insured motorist coverage included. Rates are for comparison only and are averaged for all 50 U.S. states.

| Model Year | Comprehensive | Collision | Liability | Total Premium |

|---|---|---|---|---|

| 2024 Nissan Maxima | $356 | $626 | $398 | $1,538 |

| 2023 Nissan Maxima | $344 | $610 | $416 | $1,528 |

| 2022 Nissan Maxima | $332 | $586 | $430 | $1,506 |

| 2021 Nissan Maxima | $314 | $564 | $442 | $1,478 |

| 2019 Nissan Maxima | $290 | $494 | $456 | $1,398 |

| 2018 Nissan Maxima | $278 | $442 | $460 | $1,338 |

| 2017 Nissan Maxima | $260 | $408 | $460 | $1,286 |

| 2016 Nissan Maxima | $250 | $382 | $464 | $1,254 |

| 2014 Nissan Maxima | $226 | $330 | $474 | $1,188 |

| 2013 Nissan Maxima | $220 | $300 | $478 | $1,156 |

| 2012 Nissan Maxima | $206 | $274 | $474 | $1,112 |

| 2011 Nissan Maxima | $194 | $250 | $474 | $1,076 |

| 2010 Nissan Maxima | $188 | $224 | $468 | $1,038 |

| 2009 Nissan Maxima | $184 | $218 | $460 | $1,020 |

| 2007 Nissan Maxima | $166 | $198 | $446 | $968 |

| 2006 Nissan Maxima | $160 | $188 | $442 | $948 |

Rates are averaged for all Nissan Maxima models and trim levels. Rates assume a 40-year-old male driver, full coverage with $500 deductibles, and a clean driving record.

How to Find Cheaper Nissan Maxima Insurance

Finding cheaper rates on Nissan Maxima insurance consists of being a good driver, maintaining good credit, avoid buying unnecessary coverage, and bundling your home and auto policies. Invest the time to compare rates at least every other year by quoting rates from direct carriers like GEICO, Progressive, and Esurance, and also from your local insurance agents.

The following list is a condensed summary of the car insurance concepts presented in the illustrations above.

- High-risk drivers with multiple at-fault accidents will pay on average $1,780 more each year than a safer driver

- Drivers can save as much as $190 per year simply by shopping early and online

- Increasing comprehensive and collision deductibles can save around $650 each year

- Drivers who require an increased level of liability coverage will pay an extra $460 each year to raise from a 30/60 limit to 250/500 limits

How much is insurance on a Nissan Maxima? On average, expect to pay around $129 per month or $1,550 annually. But as you’ve learned from the previous information, many different factors will impact your Nissan Maxima car insurance quotes.

For example, the age of your Nissan Maxima model as well as its trim level can majorly affect what you’ll pay for car insurance annually. You’ve seen that older Nissan Maxima’s tend to be cheaper to insure than newer models.

Similarly, your individual driver demographics will also impact your insurance rates. Insurance providers will consider your age, driving record, and the state you live in when calculating your insurance costs.

Now that we know a little more information about Nissan Maxima insurance rates, we hopefully answered the question of if a Nissan Maxima is expensive to insure. Find your best Nissan Maxima auto insurance rates for free right now by entering your ZIP code into our quote tool below.

Compare Quotes From Top Companies and SaveFree Car Insurance Comparison

Secured with SHA-256 Encryption

How does the size and class of the Nissan Maxima affect liability rates?

If you ever looked up “Nissan car insurance” to figure out how much you can expect to pay, your liability car insurance rates will depend on the size and class of the model.

Some people have asked, “is a Nissan Maxima considered a sports car?” in order to determine whether or not it’s worth the price of insurance rates. However, the Insurance Institute for Highway Safety (IIHS) classifies the Nissan Maxima as a four-door, midsize sedan.

Midsize sedans like the Maxima are generally considered to be safer than smaller vehicles such as roadsters and sports cars. This vehicle classification therefore actually helps keep your rates low.

You can compare the Nissan Maxima to other midsize sedans in the same car class in the list below.

Since insurance quotes are determined by the safety of the model, you can expect that Nissan Maxima insurance rates are more favorable than other Nissan cars. This is because the Maxima received great safety ratings, which we cover in more detail later on.

Are Nissans more expensive to insure than other car brands? Not necessarily. Nissan’s tend to fall within the average range in terms of overall car insurance costs and fees.

The car brand is popular among younger teen drivers. Due to their lack of driving experience, teen drivers receive higher than average car insurance quotes. This helps explain why the average cost to insure the Nissan Maxima seems a little high, as the teenage driver rates are also factored into the average.

However, the Nissan Maxima is one of the cheapest cars to insure overall, especially if you only pay for bodily injury liability and property damage liability insurance instead of full coverage.

What does liability insurance cost for a Nissan Maxima?

Another determining factor that will impact Nissan Maxima insurance costs is how much coverage you wish to receive for both bodily injury liability and property damage liability.

The following general quotes will show a breakdown of how much bodily injury liability costs for the Nissan Maxima from low to high coverage.

- Low ($25,000): $85.50

- Medium ($50,000): $119.62

- High ($100,000): $132.52

In case you are unfamiliar, bodily injury liability will pay for things like medical expenses for the other party while property damage liability will pay for costs associated with repairing their vehicle.

Take a look at the following property damage liability quotes for the Nissan Maxima. You might be surprised to learn that they don’t vary that much based on the level of coverage you get.

- Low ($25,000): $191.04

- Medium ($50,000): $177.56

- High ($100,000): $175.97

Now that we know how much liability insurance costs for the Nissan Maxima, you might be wondering about other determining factors that influence Nissan Maxima car insurance rates.

What are the safety features and ratings of the Nissan Maxima?

The safety features and ratings of the Nissan Maxima are very important because insurance providers take a look at this information to determine how much your policy will be.

Safety features are there to protect the driver and passengers, leading to fewer claims. In short, a model with a lot of safety features is often a good sign that insurance won’t be that expensive.

So what does this look like for the Nissan Maxima? Take a look at the following list of Nissan Maxima safety features with information sourced from AutoBlog.com.

- Anti-Lock Brakes

- Stability Control

- Front-Impact Airbags

- Side-Impact Airbags

- Overhead Airbags

- Knee Airbags

- Pretensioners

- Anti-Theft Security

As you can see, there are plenty of features you can add to your Nissan Maxima to help keep you, your passengers, and other vehicles on the road safe.

Fortunately, the Nissan Maxima safety ratings are also very strong. The Insurance Institute for Highway Safety (IIHS) awarded the 2020 Nissan Maxima with the top safety pick plus award when equipped with specific headlights.

See the details of the 2020 Nissan Maxima safety ratings below.

- Small overlap front (driver-side): Good

- Small overlap front (passenger-side): Good

- Moderate overlap front: Good

- Side: Good

- Roof strength: Good

- Head restraints & seats: Good

Like safety ratings, crash tests are also considered by insurance providers when calculating insurance costs.

In the table below, check out the Nissan Maxima crash test ratings as performed by the National Highway Traffic Safety Administration (NHTSA).

Nissan Maxima Crash Test Ratings| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2020 Nissan Maxima 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2019 Nissan Maxima 4 DR FWD | N/R | N/R | N/R | 5 stars |

| 2018 Nissan Maxima 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2017 Nissan Maxima 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2016 Nissan Maxima 4 DR FWD Later Release | 5 stars | 5 stars | 5 stars | 5 stars |

| 2016 Nissan Maxima 4 DR FWD Early Release | 5 stars | 5 stars | 5 stars | 5 stars |

A 5-star rating is the highest possible score given by the NHTSA. Overall, this car received very high marks. Your car insurance rates will be positively impacted by the Nissan Maxima’s safety ratings and crash test results.

Even though the Nissan Maxima is equipped with the preceding safety features, it is still a car and driving can be dangerous. Sometimes drivers can take all of the necessary precautions you possibly could and still end up in an unfavorable situation.

For example, data from the IIHS suggests that out of 9,736,590 registered midsize cars, a total of 396 road fatalities have been reported. For some additional context, that is a fatality rate of 41 per one million registered people who drive a vehicle similar to the Nissan Maxima.

Another thing you should concern yourself with is the impact point of certain crashes. This is because some impact point crashes can be deadlier than others.

The following statistics show how many fatalities ensued based on the origin point of the crash.

- Frontal Impact: 7,433 deaths

- Side Impact: 3,568 deaths

- Rear Impact: 834 deaths

- Other (mostly rollovers): 1,303 deaths

These statistics are not meant to scare you but inform you with real information so you can figure out if you want more protection with a comprehensive car insurance policy.

What is the MSRP of the Nissan Maxima?

The value of the car you drive goes hand-in-hand with car insurance rates. For example, certain car colors like red can end up with a higher sticker price which begs the question, “What color car is the most expensive to insure?”

Kelley Blue Book (KBB) has determined that the Manufacturer’s Suggested Retail Price (MSRP) of a base-level 2020 Nissan Maxima is $35,175 with a fair market value range between $31,572 and $34,155.

In order to protect the value of your Nissan Maxima, you will need to get car insurance coverage that extends beyond liability insurance. In other words, you need to get full coverage which is often made up by collision and comprehensive.

- Collision car insurance is a type of coverage that will pay for any costs associated with repairing or even replacing your vehicle if it gets damaged after colliding with another car or object.

- Comprehensive car insurance protects you from any damage sustained that is outside of your control, such as a tree branch falling on top of your car.

Remember that it’s ultimately your decision as to whether or not you want to get full coverage Nissan Maxima car insurance or stick to the minimum requirements determined by your state of residence.

You can also see some of the Nissan Maxima insurance loss probability details in the table below.

Nissan Maxima Insurance Loss Probability| Insurance Coverage Category | Loss Rate |

|---|---|

| Collision | 41% |

| Property Damage | -6% |

| Comprehensive | 59% |

| Personal Injury | 42% |

| Medical Payment | 40% |

| Bodily Injury | 4% |

The lower the percentage, the better the insurance loss ratio. Unfortunately, the Nissan Maxima has substantially worse than average insurance loss ratios in most categories. However, your liability loss ratios are all average.

These numbers could mean higher car insurance rates if you opt for comprehensive or collision coverage.

Expect personal injury protection (PIP) and medical payments coverage (MedPay) to also cost more with a Nissan Maxima than other vehicles in the same car class.

How much will it cost to repair my Nissan Maxima?

Lastly, every car costs a certain amount to repair. Since each model is built with a unique structure, service technicians need to approach each one differently.

In the case of the Nissan Maxima, the annual cost of repairs amounts to $540 per year, which includes routine maintenance like oil changes in addition to bigger repair jobs.

Since some vehicle parts are more expensive to repair than others, take a look at the following repair estimates for the Nissan Maxima with quotes that come courtesy of Instant Estimator:

- Front Bumper: $425.00

- Rear Bumper: $459.80

- Hood: $414.20

- Roof: $463.80

- Front Door: $401.60

- Back Door: $390.20

- Fender: $364.60

- Quarter Panel: $377.00

We have uncovered a lot of information and can pinpoint certain data depending upon the model year of your Nissan Maxima. For example, we’ve compared the cost of insurance for a 2011 Nissan Maxima to the 2009 Nissan Maxima insurance rates and even the 2018 Nissan Maxima insurance costs. Is there anything we might have missed?

If not, then you’re ready to secure your best car insurance policy. Before you buy Nissan Maxima car insurance, make sure to compare rates from multiple insurers to find the Nissan Maxima car insurance company for your needs.

To start your search for affordable Nissan Maxima car insurance, enter your ZIP code into our free online tool to start comparing Nissan Maxima quotes today.

References:

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $5,624 |

| 20 | $3,522 |

| 30 | $1,600 |

| 40 | $1,528 |

| 50 | $1,396 |

| 60 | $1,368 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,950 |

| $250 | $1,756 |

| $500 | $1,528 |

| $1,000 | $1,312 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,528 |

| 50/100 | $1,611 |

| 100/300 | $1,715 |

| 250/500 | $1,986 |

| 100 CSL | $1,653 |

| 300 CSL | $1,882 |

| 500 CSL | $2,048 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $8,040 |

| 20 | $5,604 |

| 30 | $3,386 |

| 40 | $3,310 |

| 50 | $3,156 |

| 60 | $3,126 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $82 |

| Multi-vehicle | $79 |

| Homeowner | $22 |

| 5-yr Accident Free | $115 |

| 5-yr Claim Free | $99 |

| Paid in Full/EFT | $72 |

| Advance Quote | $76 |

| Online Quote | $110 |

| Total Discounts | $655 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area