Find Cheaper Michigan Car Insurance Rates in 2025

Enter your Michigan zip code below to view companies that have cheap auto insurance rates.

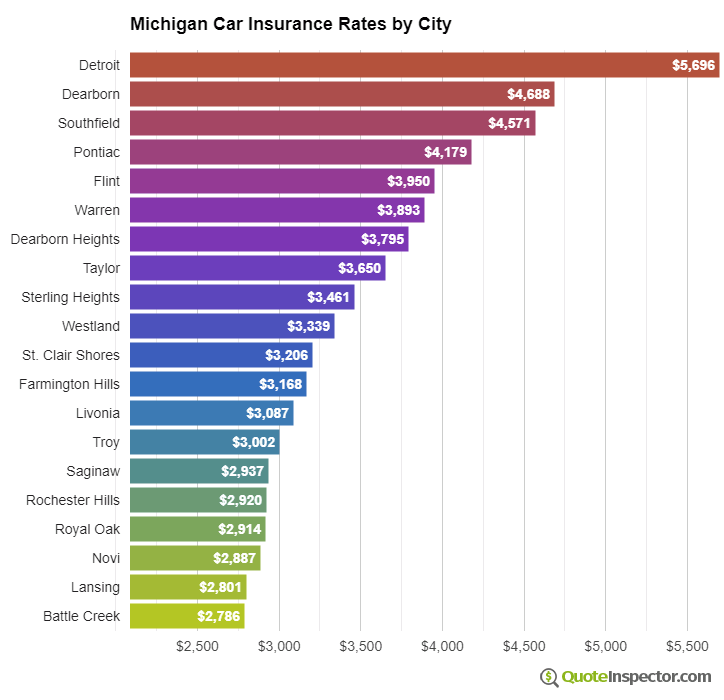

Projected insurance rates in Michigan for 2025 are $2,444 a year for full coverage insurance. Comprehensive insurance, collision insurance, and liability cost approximately $544, $992, and $632, respectively. Detroit, Dearborn, and Southfield have the most expensive auto insurance rates, and the three most popular companies in Michigan are State Farm, AAA, and Progressive.

Average rate for full coverage: $2,444

Rate estimates by type of insurance:

40-year-old driver, full coverage with $500 deductibles, and good driving record

Cost of Car Insurance in Michigan

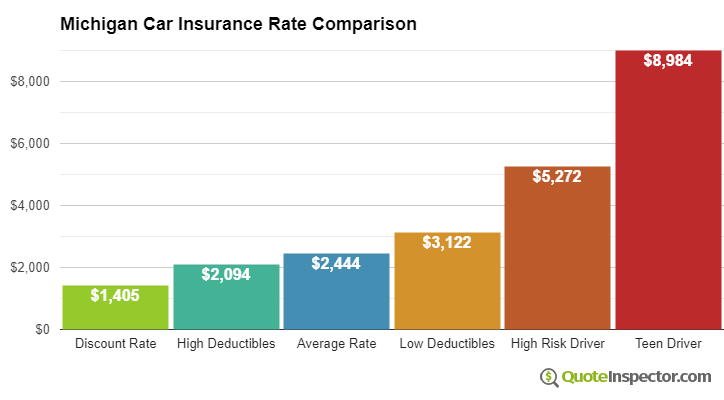

For a middle-aged driver, Michigan insurance rates range from as low as $748 for a discount liability-only rate to a much higher rate of $5,272 for a high risk driver.

These price differences illustrate why anyone shopping for car insurance should get quotes using their specific location and risk profile, instead of using average rates.

Use the form below to get accurate rates for your location.

Enter your Michigan zip code below to view companies that have cheap auto insurance rates.

Recommended Companies for Cheap Michigan Insurance

The chart estimates Michigan car insurance prices for various risk profiles and scenarios. The best price after discounts is $1,405. Michigan drivers who use higher $1,000 deductibles will pay around $2,094. The average price for a middle-aged driver with a clean driving record using $500 deductibles is $2,444. Using more expensive $100 deductibles for physical damage coverage could cause an increase to $3,122. Drivers with multiple violations and accidents could be charged around $5,272. The price for full coverage for a teenager can get as high as $8,984.

Car insurance rates in Michigan also range considerably based on your risk profile, your choice of vehicle, and physical damage deductibles and liability limits.

An older driver with no driving violations and high deductibles may pay as little as $2,200 annually on average, or $183 per month, for full coverage. Rates are much higher for teenagers, where even good drivers will be charged in the ballpark of $8,900 a year. View Rates by Age

The city you live in plays a big part in determining prices for auto insurance prices. Areas with less traffic congestion could have rates as low as $1,900 a year, whereas some neighorhoods in Detroit and Dearborn may see rates upwards of $5,700. Geographically different areas within the same city can have significantly different rates.

These geographic rate differences highlight the importance of getting rates based on your location.

The company you buy your policy from obviously affects the cost of coverage. In Michigan, every insurance company has their own rate formula, and prices can be substantially lower or higher based upon different risk factors.

In Michigan, auto insurance prices range from $1,058 with Safeco to as high as $4,730 with Encompass. Other companies like USAA, GEICO, and MetLife generally fall somewhere towards the middle. Those most likely are not the rates you would pay, as your motor vehicle report, the type of vehicle you drive, and where you live in Michigan have to be considered.

| Rank | Company | Market Share | Average Rate |

|---|---|---|---|

| 1 | State Farm | 18.53% | $2,948 |

| 2 | AAA | 15.90% | $2,440 |

| 3 | Progressive | 10.96% | $1,885 |

| 4 | Auto Owners | 9.60% | $1,669 |

| 5 | Allstate | 8.99% | $3,065 |

| 6 | The Hanover | 5.72% | $2,352 |

| 7 | Liberty Mutual | 4.64% | $3,509 |

| 8 | Michigan Farm Bureau | 4.53% | $2,625 |

| 9 | USAA | 2.67% | $968 |

| 10 | Geico | 2.37% | $1,013 |

| Get Your Rates Quote Now | |||

Source: National Association of Insurance Commissioners (NAIC) 2015 Market Share Report and The Zebra

Using high physical damage deductibles can save as much as $1,030 every year, while increasing your policy's liability limits will push rates upward. Switching from a 50/100 limit to a 250/500 limit will raise rates by up to $569 extra every 12 months. View Rates by Deductible or Liability Limit

If you have a few points on your driving record or tend to cause accidents, you are probably paying anywhere from $2,800 to $3,900 extra every year, depending on your age. High-risk driver insurance ranges as much as 43% to 128% more than a normal policy. View High Risk Driver Rates

The type of vehicle you drive is a large factor when calculating the price of auto insurance coverage in Michigan. Electing to drive a more affordable and lower-performance vehicle will cost less to insure thanks to cheaper replacement cost and reduced frequency of accidents. The table below shows premium estimates for the best selling vehicles in Michigan.

| Make and Model | Premium | % to Avg |

|---|---|---|

| Chevrolet Silverado | $2,576 | 5.1% |

| Dodge Ram | $2,648 | 7.7% |

| Ford Escape | $2,034 | -20.2% |

| Ford Focus | $2,364 | -3.4% |

| Ford Fusion | $2,590 | 5.6% |

| Ford F-150 | $2,296 | -6.4% |

| GMC Acadia | $2,248 | -8.7% |

| GMC Sierra | $2,536 | 3.6% |

| Honda Accord | $2,280 | -7.2% |

| Honda Civic | $2,668 | 8.4% |

| Honda CR-V | $1,978 | -23.6% |

| Honda Pilot | $2,320 | -5.3% |

| Hyundai Sonata | $2,474 | 1.2% |

| Kia Optima | $2,522 | 3.1% |

| Nissan Altima | $2,512 | 2.7% |

| Nissan Rogue | $2,452 | 0.3% |

| Toyota Camry | $2,488 | 1.8% |

| Toyota Corolla | $2,434 | -0.4% |

| Toyota Prius | $2,266 | -7.9% |

| Toyota RAV4 | $2,302 | -6.2% |

| Get Rates for Your Vehicle Quote Now | ||

Annual estimated premium for full coverage, $500 deductibles, driver age 40 with clean driving record.

View additional vehicles

Because rates have so much variability, the only way to figure out which company is cheapest is to compare rates and see which company has the best rate. Each auto insurer uses a different method to calculate rates, so rate quotes will be varied from one company to the next.

Michigan Auto Insurance Articles

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $8,984 |

| 20 | $5,638 |

| 30 | $2,558 |

| 40 | $2,444 |

| 50 | $2,228 |

| 60 | $2,188 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $3,122 |

| $250 | $2,806 |

| $500 | $2,444 |

| $1,000 | $2,094 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $2,444 |

| 50/100 | $2,570 |

| 100/300 | $2,728 |

| 250/500 | $3,139 |

| 100 CSL | $2,634 |

| 300 CSL | $2,981 |

| 500 CSL | $3,234 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $12,832 |

| 20 | $8,950 |

| 30 | $5,402 |

| 40 | $5,272 |

| 50 | $5,032 |

| 60 | $4,982 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $130 |

| Multi-vehicle | $125 |

| Homeowner | $34 |

| 5-yr Accident Free | $183 |

| 5-yr Claim Free | $157 |

| Paid in Full/EFT | $115 |

| Advance Quote | $122 |

| Online Quote | $173 |

| Total Discounts | $1,039 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates Now