Find Cheaper San Diego, CA Car Insurance Rates in 2025

Enter your California Auto Insurance zip code below to view companies that have cheap auto insurance rates.

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

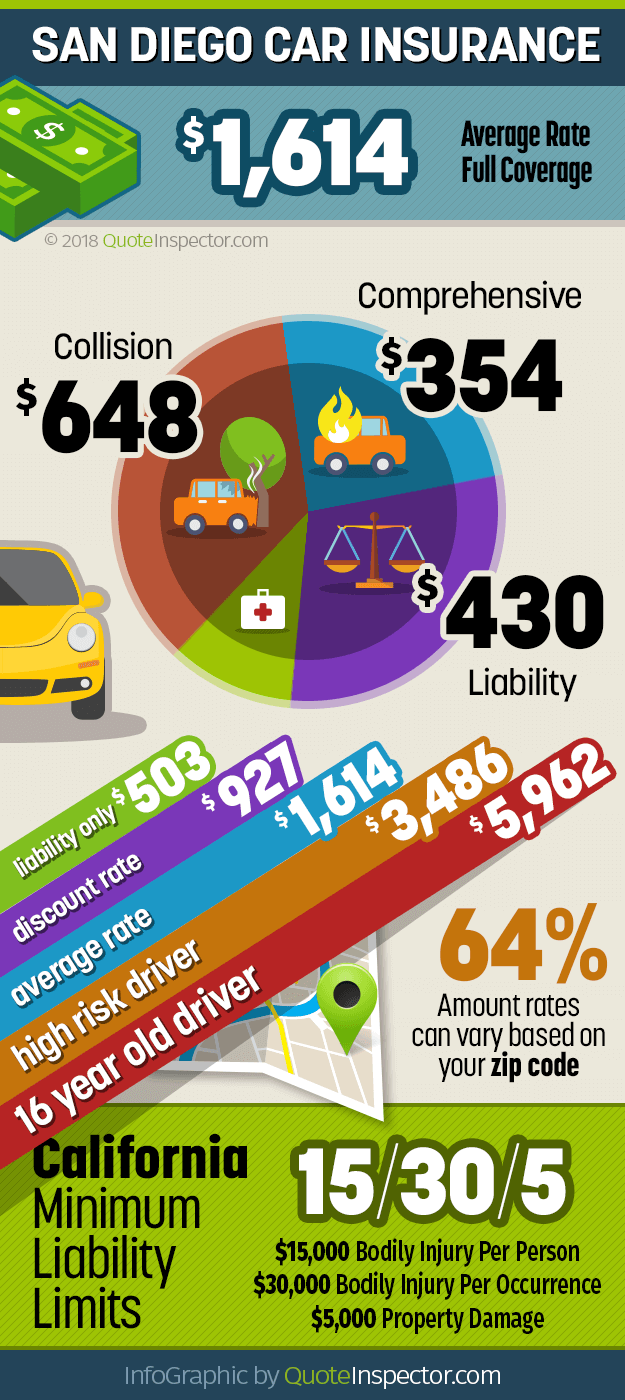

San Diego drivers can expect average car insurance prices to be $1,614 a year, or about $134 a month for full coverage. Policy discounts could get the rate as low as $927, and liability-only rates are estimated at $503 a year. State Farm, Farmers, and Allstate insure over 35% of the vehicles in San Diego, and USAA has the cheapest rates if drivers have a military affiliation.

The figure below shows the average rate and prices for individual policy coverage types.

Annual premium for full coverage: $1,724

:

Rates are estimated based on a 40-year-old driver with a clean driving record and rated on an average passenger sedan like a Honda Accord, Toyota Camry, or Ford Focus.

Price Range by Policy Type

A policy with only liability insurance will be the most affordable, but it does not provide protection for damage to your vehicle from perils like theft, fire, or collision. California requires drivers to buy minimum liability insurance limits of 15/30/5, which means $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per occurrence, and $5,000 of property damage insurance. These are not high limits and can quickly be exhausted even in a minor accident, so consider buying higher limits for additional protection.

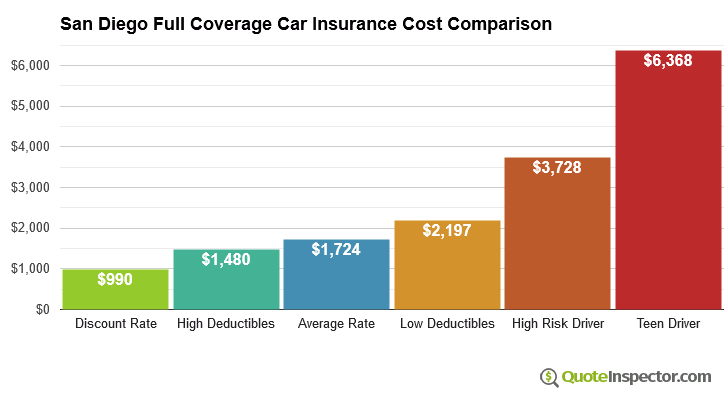

Drivers who have multiple violations on their driving record or have an adverse claim history may be forced to buy coverage from the non-standard or high-risk market. Rates for these policies are considerably higher than the average full coverage policy as shown below.

Full Coverage Policy Price Comparisons

The chart below shows how rates are affected by different scenarios. The cheapest discount price is what drivers can expect to pay if they are a preferred risk and qualify for the majority of discounts offered by their company.

The high deductible, average rate, and low deductible prices show how choosing different physical damage deductibles (comprehensive and collision) affect policy prices. High deductibles save drivers money because in the event of a claim, the policyholder pays more of the repair cost. With low deductibles, the insurance company pays more, which equates to high prices.

In this example, drivers could see savings of $669 a year by choosing $1,000 deductibles rather than the more expensive $100 deductibles. At that price point, as long as your average time between claims is 16 months or more, you will come out ahead financially by choosing the higher deductible.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Rates by Make and Model of Vehicle

San Diego has all types of vehicles, from sporty sun chasers cruising the coast to tough four-wheel drive jeeps and trucks traversing Otay Mountain. Whatever vehicle you drive, it’s going to have an effect on the rate you pay to insure it.

Exotic, expensive, or high-performance vehicles cost more to insure due to the higher cost to repair and a naturally higher actual cash value. Larger 3/4 and 1-ton trucks tend to be more expensive than average due to having a higher-than-average liability claim frequency.

The table below shows estimated auto insurance costs for a variety of popular vehicles in the San Diego area.

| Make and Model | Annual Premium | Monthly Premium |

|---|---|---|

| Chevrolet Silverado | $1,827 | $152 |

| Dodge Ram | $1,879 | $157 |

| Ford Escape | $1,441 | $120 |

| Ford Focus | $1,674 | $140 |

| Ford Fusion | $1,834 | $153 |

| Ford F-150 | $1,626 | $136 |

| GMC Acadia | $1,594 | $133 |

| GMC Sierra | $1,797 | $150 |

| Honda Accord | $1,614 | $135 |

| Honda Civic | $1,892 | $158 |

| Honda CR-V | $1,402 | $117 |

| Honda Pilot | $1,644 | $137 |

| Hyundai Sonata | $1,756 | $146 |

| Kia Optima | $1,788 | $149 |

| Nissan Altima | $1,780 | $148 |

| Nissan Rogue | $1,739 | $145 |

| Toyota Camry | $1,763 | $147 |

| Toyota Corolla | $1,724 | $144 |

| Toyota Prius | $1,605 | $134 |

| Toyota RAV4 | $1,631 | $136 |

| Get Rates for Your Vehicle Go | ||

Top Ten Car Insurance Companies in San Diego

The companies listed below are ranked by market share, with average rates in the state of California. San Diego’s rates are really quite low compared to some other areas in California like Los Angeles and San Francisco. Car insurance prices in San Diego run right around the state average.

State Farm is the largest insurer in the state of California, with Farmers Insurance a close second. USAA has the best overall car insurance prices in San Diego, but drivers have to have a military affiliation in order to buy from them. With San Diego’s large naval presence, USAA would be a good option for many families.

| Rank | Company | Market Share | Average Rate |

|---|---|---|---|

| 1 | State Farm | 14.45% | $1,716 |

| 2 | Farmers Insurance | 12.45% | $1,986 |

| 3 | Allstate | 8.74% | $1,528 |

| 4 | Mercury General | 8.27% | $1,518 |

| 5 | Auto Club | 8.11% | $2,526 |

| 6 | Geico | 7.81% | $1,544 |

| 7 | CSAA | 6.58% | $1,210 |

| 8 | USAA | 4.49% | $1,132 |

| 9 | Progressive | 4.17% | $1,527 |

| 10 | Liberty Mutual | 3.40% | $2,241 |

| Get Your Rates Go | |||

Source: National Association of Insurance Commissioners (NAIC) 2015 Market Share Report and The Zebra

Top Ten Ways to Save on San Diego Car Insurance

We covered a lot of rate information, but chances are you’re looking for ways to find cheaper auto insurance. The following are our top ten ways to save money when shopping for coverage in San Diego.

- If your car is getting older and the cost for comprehensive and collision coverage is more than 10% of the actual cash value of the vehicle, you might consider dropping full coverage

- Raising physical damage deductibles can save up to $700 a year. If you have adequate savings, consider this step to reduce rates.

- Take a hard look at your policy coverages and eliminate the one’s you really don’t need. This might include things like an auto club membership, towing coverage, or rental reimbursement.

- Make sure you’re earning all the discounts you’re entitled to. Some are more difficult to determine if you qualify, so ask your agent or company.

- If you’re in the market for a new vehicle, check rate quotes with several agents or companies prior to purchasing. You may find that the difference in insurance prices may be the determining factor of which model you buy.

- If you have a teen driver on your policy with full coverage, consider dropping comprehensive and collision and only insuring for liability.

- If you normally have a clean driving record but you get a ticket, check into a driver’s safety course that could keep the ticket off your record.

- Never allow coverage to lapse between policies. Companies want to see that you have maintained continuous coverage, and if you have a gap, chances are good you’ll pay a surcharge.

- If you’re looking at switching companies, quote your policy well ahead of the renewal date and do it online. Many companies offer big discounts if you are prompt and do the work yourself.

- The best way to lower your San Diego car insurance rates is to shop around. There are a lot of companies to choose from, and if you take a little time to compare rates, you could save some serious cash. Price quotes are always free and the more quotes you get, the more potential you have to save.

Frequently Asked Questions

What is the average car insurance cost in San Diego, CA?

San Diego drivers can expect average car insurance prices to be around $1,614 per year or approximately $134 per month for full coverage. However, rates can vary depending on several factors such as the driver’s age, driving record, and the type of coverage chosen.

What are the estimated price ranges for different types of car insurance policies in San Diego?

The estimated price ranges for car insurance policies in San Diego are as follows:

- Liability-only policy: $503 per year

- Full coverage policy: $1,614 per year (average)

- Full coverage policy with discounts: As low as $927 per year

Which insurance companies are popular in San Diego?

State Farm, Farmers, and Allstate are among the most popular insurance companies in San Diego, insuring over 35% of the vehicles in the area. USAA offers the cheapest rates for drivers with military affiliations.

How does the choice of policy deductibles affect car insurance rates?

The choice of policy deductibles can have an impact on car insurance rates. Higher deductibles, where the policyholder pays more out of pocket in the event of a claim, can result in lower premiums. On the other hand, lower deductibles require the insurance company to pay more, leading to higher premiums.

How does the make and model of a vehicle affect car insurance rates in San Diego?

The make and model of a vehicle can affect car insurance rates. Exotic, expensive, or high-performance vehicles tend to be more expensive to insure due to higher repair costs and higher actual cash value. Larger trucks may also have higher insurance rates due to a higher liability claim frequency.

What are some ways to save on car insurance in San Diego?

Here are the top ways to save money on car insurance in San Diego:

- Compare quotes from multiple insurance companies.

- Maintain a good driving record.

- Take advantage of available discounts.

- Opt for higher deductibles.

- Bundle your car insurance with other policies.

- Consider usage-based or pay-per-mile insurance.

- Drive a vehicle with safety features.

- Install anti-theft devices in your car.

- Maintain a good credit score.

- Review your coverage periodically to ensure it meets your needs.

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $6,368 |

| 20 | $3,983 |

| 30 | $1,806 |

| 40 | $1,724 |

| 50 | $1,572 |

| 60 | $1,547 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $2,197 |

| $250 | $1,979 |

| $500 | $1,724 |

| $1,000 | $1,480 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,724 |

| 50/100 | $1,815 |

| 100/300 | $1,930 |

| 250/500 | $2,227 |

| 100 CSL | $1,861 |

| 300 CSL | $2,113 |

| 500 CSL | $2,296 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $9,094 |

| 20 | $6,329 |

| 30 | $3,817 |

| 40 | $3,728 |

| 50 | $3,558 |

| 60 | $3,525 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $92 |

| Multi-vehicle | $89 |

| Homeowner | $24 |

| 5-yr Accident Free | $129 |

| 5-yr Claim Free | $111 |

| Paid in Full/EFT | $81 |

| Advance Quote | $86 |

| Online Quote | $122 |

| Total Discounts | $734 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates Now

Find companies with the cheapest rates in San Diego