Find Cheaper Tennessee Car Insurance Rates in 2025

Enter your Tennessee zip code below to view companies that have cheap auto insurance rates.

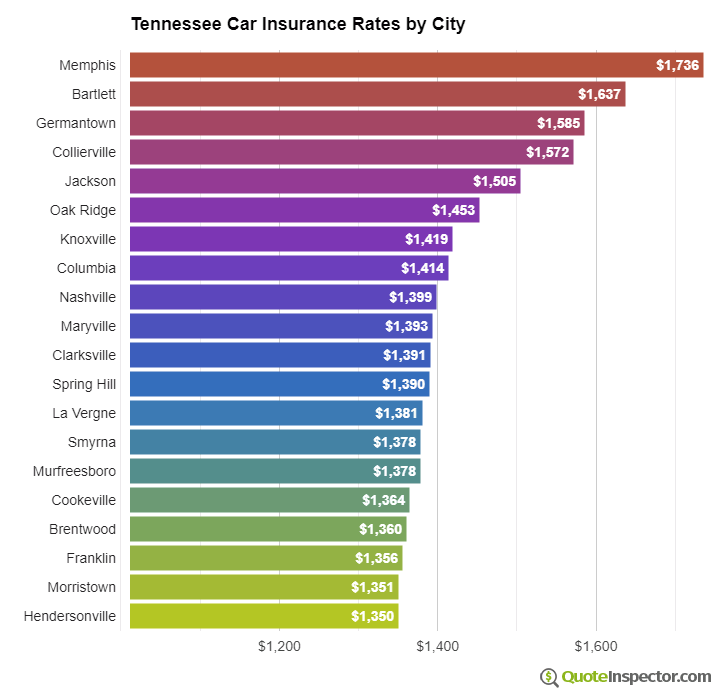

Average insurance prices in Tennessee for 2025 are $1,232 every 12 months for full coverage. Comprehensive insurance, collision insurance, and liability cost an estimated $274, $500, and $318, respectively. Memphis, Bartlett, and Germantown have more expensive car insurance rates, and the three companies who insure the most vehicles in Tennessee are State Farm, Tennessee Farmers, and Geico.

Average rate for full coverage: $1,232

Policy rates broken down by type of coverage:

40-year-old driver, full coverage with $500 deductibles, and good driving record

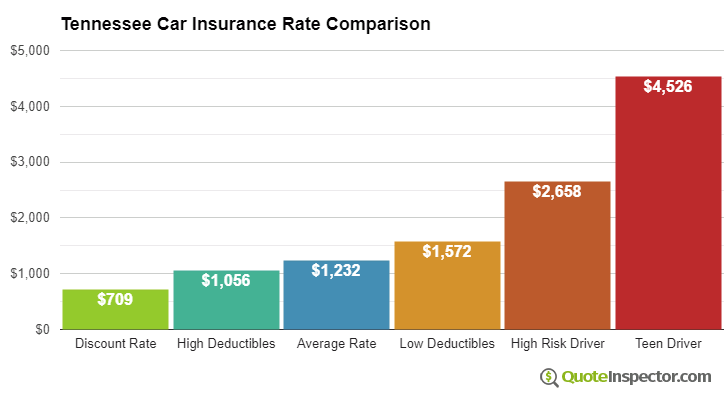

Average Price Range for Car Insurance in Tennessee

Using a 40-year-old driver as an example, Tennessee insurance prices range from the cheapest price of $376 for just liability coverage to the much higher price of $2,658 for a policy for a high-risk driver.

These price ranges show why everyone should compare prices for a targeted area and their own driving history, instead of depending on rates averaged for all U.S. states.

Use the form below to get accurate rates for your location.

Enter your Tennessee zip code below to view companies that have cheap auto insurance rates.

Recommended Companies for Cheap Tennessee Insurance

Chart shows Tennessee car insurance rates for various coverage choices and risks. The cheapest discount rate is $709. Drivers choosing higher $1,000 deductibles will pay $1,056. The average rate for a driver around age 40 using $500 deductibles is $1,232. Selecting more expensive $100 deductibles for comprehensive and collision insurance could cost up to $1,572. If you have multiple accidents and violations you could be charged at least $2,658. The rate for full coverage for a teenage driver can be as high as $4,526.

Insurance rates in Tennessee are also quite variable based on deductibles and policy limits, your driver profile, and your choice of vehicle.

If you have some driving violations or you were responsible for an accident, you could be paying $1,500 to $2,000 extra each year, depending on your age. Insurance for high-risk drivers can be from 44% to 136% more than the average rate. View High Risk Driver Rates

Opting for high physical damage deductibles could cut rates by as much as $520 annually, whereas buying more liability protection will increase premiums. Going from a 50/100 liability limit to a 250/500 limit will increase rates by as much as $286 more per year. View Rates by Deductible or Liability Limit

Your auto insurance company has an impact on price. Each company has a slightly different rate calculation, and prices have large differences depending on individual risk factors.

In Tennessee, auto insurance prices range from $752 with Utica National to as high as $2,315 with Safeco. Other companies like Auto-Owners, Cincinnati Insurance, and Penn National fall somewhere in between. These are probably not the prices you would pay, as where you live in Tennessee, the type of vehicle you drive, and your driving history have to be factored in.

| Rank | Company | Market Share | Average Rate |

|---|---|---|---|

| 1 | State Farm | 23.64% | $1,189 |

| 2 | Tennessee Farmers | 17.02% | $942 |

| 3 | Geico | 7.19% | $1,133 |

| 4 | Allstate | 7.13% | $1,859 |

| 5 | Progressive | 6.49% | $1,202 |

| 6 | Liberty Mutual | 5.51% | $1,925 |

| 7 | USAA | 5.27% | $938 |

| 8 | Nationwide | 4.62% | $1,022 |

| 9 | Erie Insurance | 2.38% | $977 |

| 10 | Farmers Insurance | 2.21% | $1,645 |

| Get Your Rates Quote Now | |||

Source: National Association of Insurance Commissioners (NAIC) 2015 Market Share Report and The Zebra

A more mature driver with a clean driving record and higher deductibles may pay as low as $1,100 a year for full coverage. Rates are highest for teenage drivers, since even excellent drivers can expect to pay at least $4,500 a year. View Rates by Age

The type of car, truck, or SUV you buy is a primary factor in determining the price you pay for car insurance in Tennessee. Buying a cheaper and safer vehicle will have a lower insurance cost primarily due to cheaper repair costs and lower severity of accident injuries. The following table shows car insurance premium estimates for the most popular vehicles that are insured in Tennessee.

| Make and Model | Premium | % to Avg |

|---|---|---|

| Chevrolet Silverado | $1,298 | 5.1% |

| Dodge Ram | $1,334 | 7.6% |

| Ford Escape | $1,024 | -20.3% |

| Ford Focus | $1,192 | -3.4% |

| Ford Fusion | $1,308 | 5.8% |

| Ford F-150 | $1,158 | -6.4% |

| GMC Acadia | $1,134 | -8.6% |

| GMC Sierra | $1,280 | 3.8% |

| Honda Accord | $1,150 | -7.1% |

| Honda Civic | $1,344 | 8.3% |

| Honda CR-V | $996 | -23.7% |

| Honda Pilot | $1,170 | -5.3% |

| Hyundai Sonata | $1,248 | 1.3% |

| Kia Optima | $1,272 | 3.1% |

| Nissan Altima | $1,268 | 2.8% |

| Nissan Rogue | $1,236 | 0.3% |

| Toyota Camry | $1,256 | 1.9% |

| Toyota Corolla | $1,228 | -0.3% |

| Toyota Prius | $1,142 | -7.9% |

| Toyota RAV4 | $1,162 | -6% |

| Get Rates for Your Vehicle Quote Now | ||

Annual estimated premium for full coverage, $500 deductibles, driver age 40 with clean driving record.

View additional vehicles

The area you live in has a huge impact on auto insurance prices. Less congested rural areas could see prices as low as $900 a year, while some neighborhoods in Memphis and Bartlett may have prices as high as $1,800. Even different neighborhoods close to each other in the same city can have large rate differences.

These price discrepancies illustrate the significance of getting rates for your specific Tennessee zip code.

Since rates can be so different, the only way to know who has the cheapest car insurance rates is to regularly compare rates from multiple companies. Each insurance company utilizes a different rate formula, so the rates may be quite different.

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $4,526 |

| 20 | $2,840 |

| 30 | $1,288 |

| 40 | $1,232 |

| 50 | $1,122 |

| 60 | $1,100 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,572 |

| $250 | $1,414 |

| $500 | $1,232 |

| $1,000 | $1,056 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,232 |

| 50/100 | $1,296 |

| 100/300 | $1,375 |

| 250/500 | $1,582 |

| 100 CSL | $1,327 |

| 300 CSL | $1,502 |

| 500 CSL | $1,630 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $6,466 |

| 20 | $4,510 |

| 30 | $2,720 |

| 40 | $2,658 |

| 50 | $2,534 |

| 60 | $2,510 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $66 |

| Multi-vehicle | $63 |

| Homeowner | $17 |

| 5-yr Accident Free | $92 |

| 5-yr Claim Free | $79 |

| Paid in Full/EFT | $58 |

| Advance Quote | $61 |

| Online Quote | $87 |

| Total Discounts | $523 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates Now